SuperAngel.Fund x Q4 2023 Recap 🔥

SuperAngel.Fund is an early stage fund that invests in Consumer (CPG, eCommerce SaaS), PropTech & Future of Work.

Happy Friday!

As always, I am excited to share the quarterly recap for SuperAngel.Fund.

During the quarter we made 13 investments with a median check size of $25k and post-money valuation of $16m. Our investments were spread across Consumer (8), eCommerce SaaS (4), and Future of Work (1).

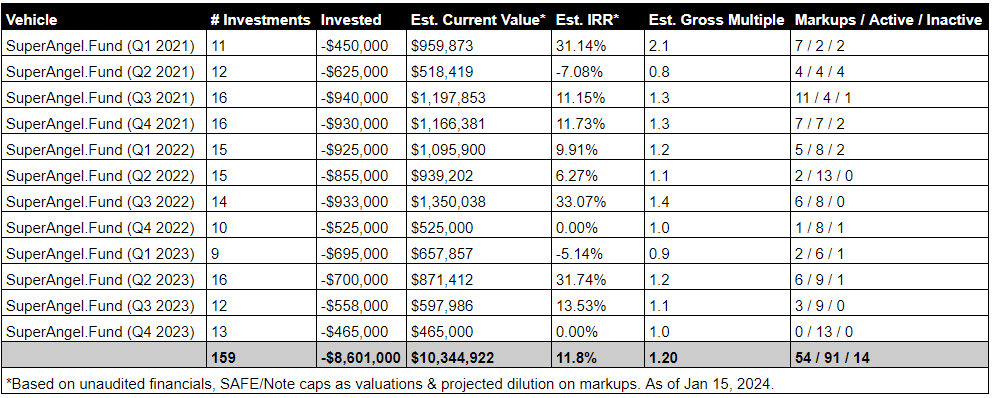

Since the fund started in January 2021 we have deployed $8.6m across 159 investments into 107 companies. I estimate the current value to be $10.3m which represents a 11.8% unrealized IRR and 1.2x gross multiple. So far, 54 investments have seen a markup, 91 are active without yet a change in price, and 14 are no longer active. Click here to view a detailed performance summary and see below for a quarterly overview.

In addition to the fund, Super Angel Syndicate provides an opportunity to contribute more, from time to time, into individual companies via special purpose vehicles (SPVs). Since 2017, the syndicate has deployed $8.4m across 25 investments into 16 companies. I estimate the current value to be $15.5m which represents a 24.6% partially realized IRR and 1.84x gross multiple. So far, 15 investments have seen a markup or distribution, nine are active without yet a change in price and one is no longer active. Click here to view a detailed performance summary.

Across my angel, fund and syndicate portfolio, I’ve invested $17.5m into 126 companies since 2014. I estimate the current value to be approximately $30m, which represents a 26% IRR.

Q4 2023 Investments

Cadence: Sustainable travel containers for everyday personal care & beauty items

Windmill: Smart ‘air-care’ products & technology

Perry: Workforce recruiting & retention

Bandit: Community-driven brand for runners

STAND: The best shoes for standing

Rorra: The future of water filtration

Hoop: Resale technology platform

Lalo: Baby & toddler products you are proud to own

Create: Modern creatine brand

Freestyle: Babycare brand starting with diapers

Hetal: Retail audit & analytics platform

Mantle: Revenue & Ops platform for SaaS companies

Confidential: Stealth

Market Commentary

While most industry-leading data sources are still putting the finishing touches on their Q4 market reports, below are a few early trends worth sharing:

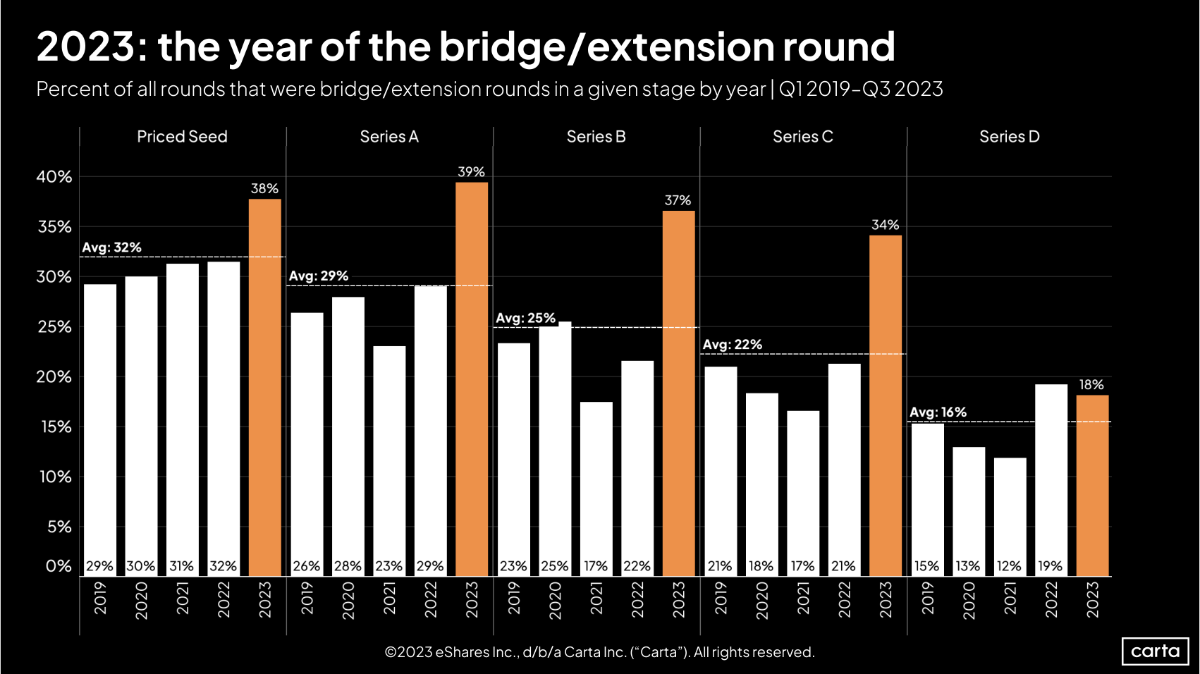

Bridge Rounds ⬆️

2023 was the year of the bridge round. Per Carta, 2023 saw the highest number of bridge rounds compared to the prior four years, by a wide margin. During the year, at least 4 out of every 10 funding rounds were categorized as a bridge or extension round. This means that early stage companies which raised money did so primarily with backing from their existing investors as opposed to new ones. Given the macroeconomic environment that we find ourselves in, this statistic is no surprise. More often, it is easier for a company to gain additional support from its existing investor base as compared to net new investors. In doing so, startups are often willing to maintain their previous valuation creating a favorable situation for both parties. For one, these investors are already familiar with the company/team which leads to a quicker process. And secondly, existing investors already have a financial interest in the company’s success and are therefore most incented to keep it going. While no investor attempts to “throw good money after bad” by incurring further loss in an attempt to recoup a previous loss, there are many examples of these investments turning into winners (see ‘How investing in bridge rounds landed us multiple 10x returns’). The key, of course, is to be extra discerning over which of your existing companies make sense to help “bridge” the gap for until their next funding round, or, the point at which they reach cash flow breakeven or better yet, profitability.

I expect this trend will continue into 2024. As it relates to us at SuperAngel.Fund, we leaned into this strategy pretty heavily. In 2023, we made 21 investments into net new companies (42%) and participated in 29 follow ons (58%). That compares to 2022 where we invested in 36 net new companies (66%) and only 18 follow ons (33%). I often say that follow ons are my favorite type of investment. As mentioned above, when investing into a company we are familiar with, we benefit from ‘insider’ information and a pre-existing relationship or connection to the founders. In these cases, we have the benefit of watching teams execute through ups and downs over an extended period of time. These historical data points provide a meaningful advantage over outsiders who don’t have this context, and who may not even be aware that the investment opportunity exists! After all, a key ‘perk’ to private market investing is to capitalize on ‘private’ information that the general public may not know. That is the case with follow ons. For founders too, when possible, many also prefer to raise from their existing investor base so as to maintain consistency and optimize for speed in due diligence and closing. If I am doing my job right the first time in “picking winners”, at least for a few subsequent rounds, our best deal flow should come from our existing portfolio.

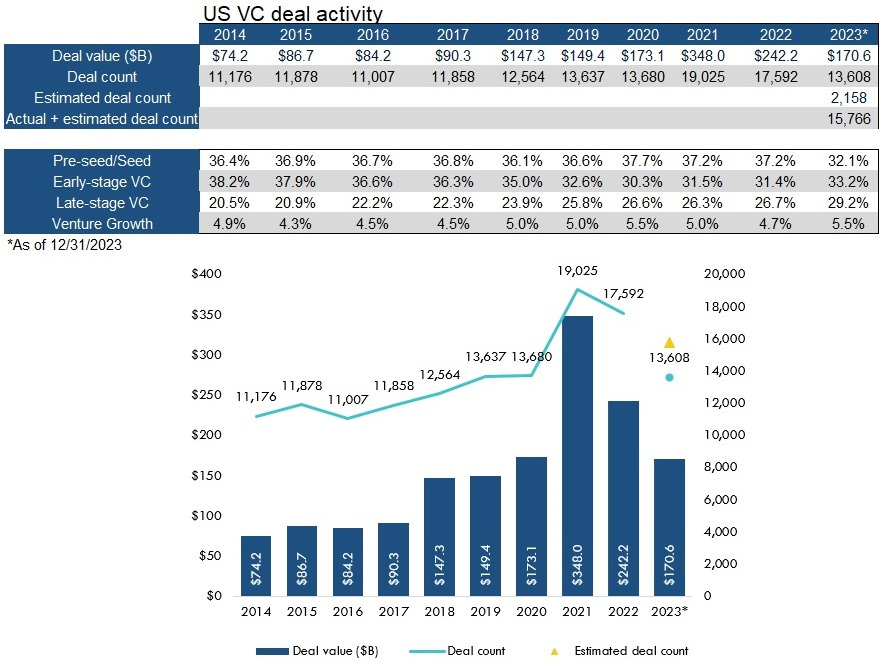

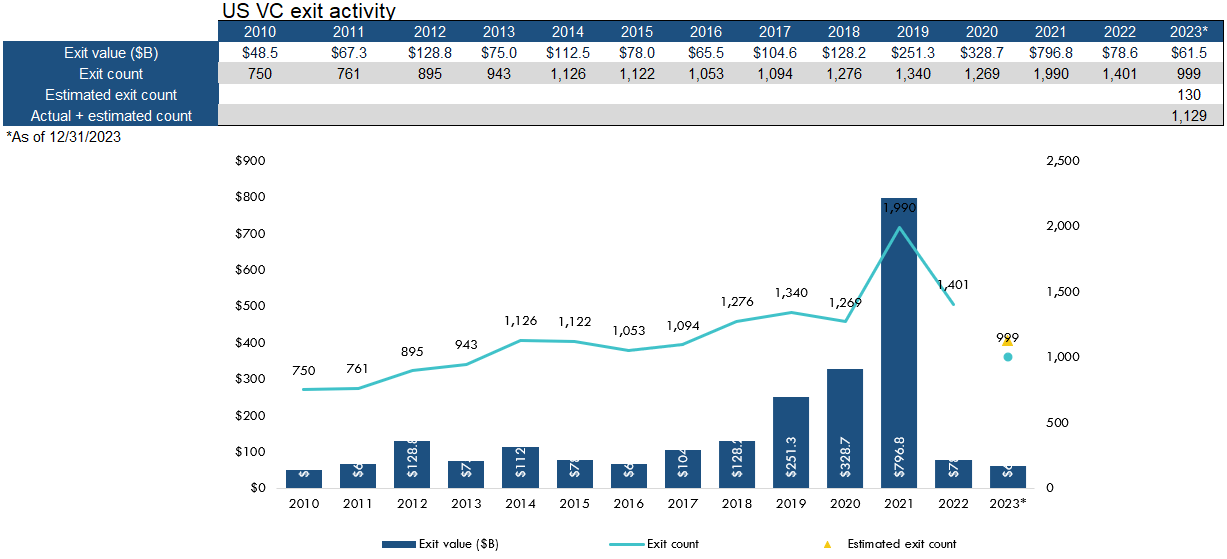

VC Activity ⬇️

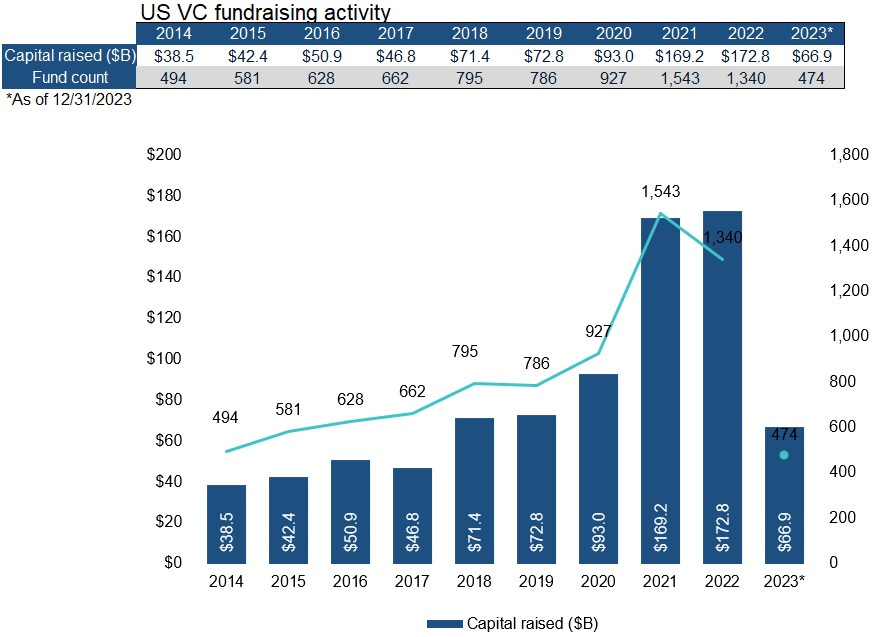

According to PitchBook and the National Venture Capital Association, 2023 saw the lowest level of venture investment activity in the U.S. since 2019. There were approximately 15k total deals completed representing $170 billion invested (see chart 1 below). This is roughly half of the amount invested in 2021 and highlights the reduced risk appetite for early stage private companies. Additionally, exits returned just $62 billion last year, the lowest amount since 2010, and less than 10% of the $797 billion during the 2021 peak! (chart 2). This lack of liquidity drove a corresponding drop in capital committed to venture funds who rely heavily on LPs recycling money back into the system (chart 3).

Looking back at last year’s year-end update, I correctly identified that these trends, which started in 2022, would continue through 2023 just as they have done. Moreover, I predicted these trends would likely continue through 2024, and, looking at the world as it stands today I reaffirm that prediction. See excerpt below from my 2022 update:

“...The amount of capital invested, and number of financings, have decreased substantially in the last quarter…That said, these figures do not yet incorporate deals closed in Q4 2022, which, I believe will show a much more substantial decline in valuations for pre-seed and seed rounds than the preceding quarters of the year. If my inclination is correct, the next few years may be some of the best to invest in early stage companies…I believe the trends above will continue over the next 12-24 months. We are likely to see further downward pressure on valuations, particularly for first time or otherwise overlooked founders, within our sectors of focus. Our own data over the past two quarters has also shown new deals priced more reasonably, both for follow-on investments in our top performers, and for new companies as well. While there are historic amounts of venture capital dollars on the sidelines, much of it waiting for the market to feel more “stable”, we continue to invest, seeking founders and opportunities that go against the herd. As Warren Buffett famously said: “Be fearful when others are greedy, and be greedy when others are fearful.”

Record Shutdowns ⬆️

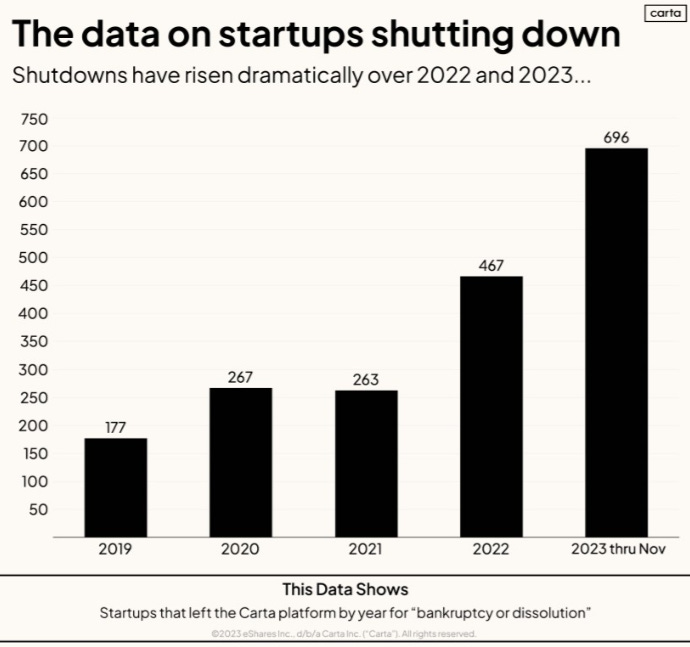

With fewer venture dollars at play it is no surprise that a record number of startups shut down in 2023. According to Carta, through November 2023, nearly 700 startups that use their platform shut down compared to a total of 467 in 2022, and 263 in 2021. See below excerpt from a recent blog post from Peter Walker, Head of Insights at Carta, titled “Why this year is different for startups going bankrupt”:

“This data is the bad echo of the over-exuberance of startup boom times (roughly late 2020-early 2022). Everyone is familiar with that stat "9 out of 10 startups go bankrupt". This remains roughly true - if you're looking at all startups from idea stage to pre-IPO. However, there should be some decline in that failure rate as a startup moves through the fundraising cycle. Hopefully they are de-risking the business with each successive round, making an eventual IPO or solid acquisition much more likely. So - why is 2023 different? Because even startups that have raised significant VC cash are closing down.”

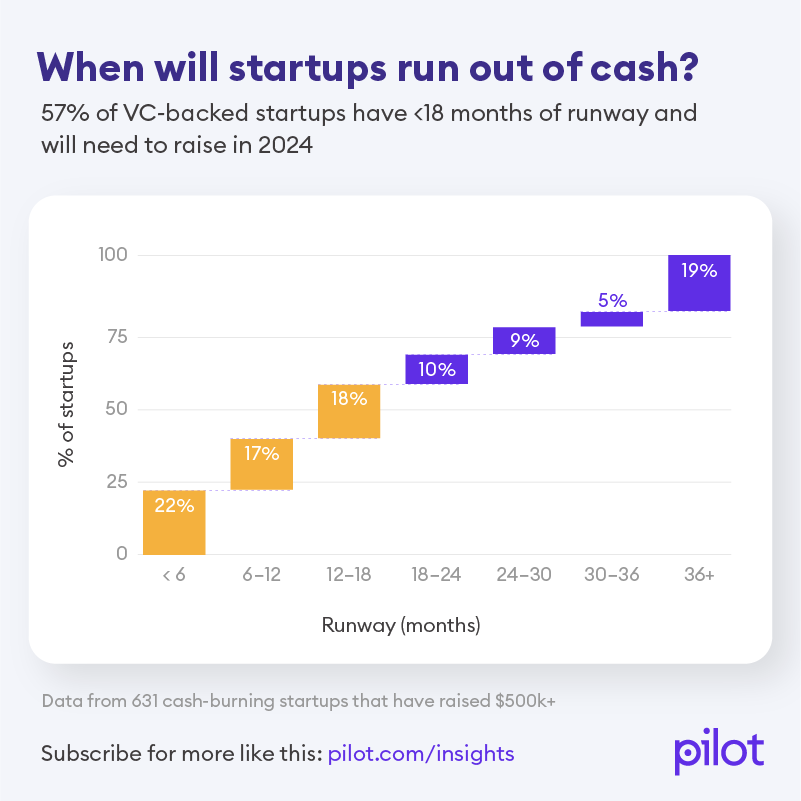

Many investors, myself included, believe this “correction” will continue through 2024. According to Pilot, an outsourced bookkeeping, CFO and tax services firm that works with thousands of startups, 57% of VC-backed startups have less than 18 months of runway. With the average financing process taking up to six months from start to finish, most will need to fundraise in 2024. While maintaining a short runway may seem uncomfortable to many people or small business owners, it is a very common practice that is, in part, by design in venture finance. However, with less capital expected to be accessible this year compared to prior years, founders will need to compete more than ever for investor dollars. This, in turn, creates a phenomenal “buying” opportunity. As I wrote last quarter:

“However harsh these macroeconomic shifts are for startups seeking capital, for investors like us with a long term approach, patience and dry powder, it presents the opportunity to capitalize on extremely favorable valuations. And, as a result of these lower prices, we are able to buy more ownership in the companies that we choose to invest in for the same dollars that we would have been able to previously. For companies that prove successful, these dynamics will greatly enhance our distributions and return profile.”

Small Checks ⬆️

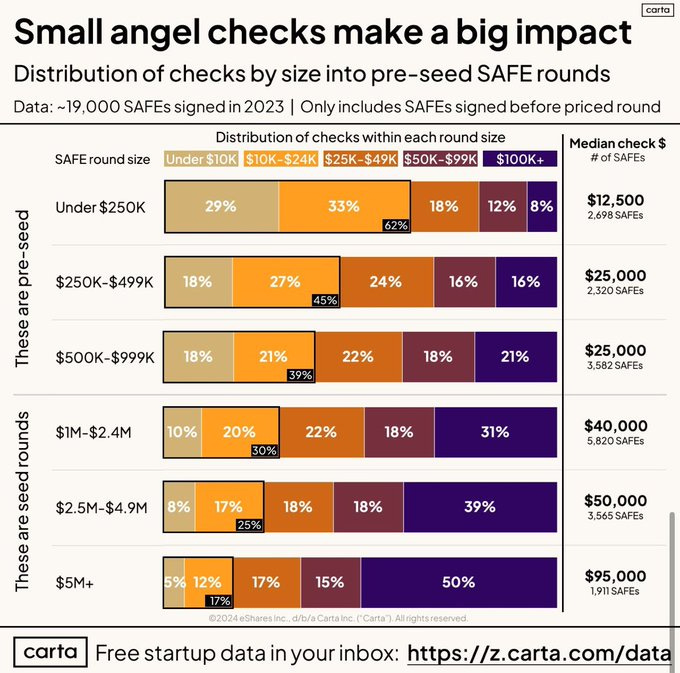

Over the years I have noticed that there is a misconception amongst many that angel investing is reserved for wealthy individuals who have the capacity to invest $50k - $100k or more per deal. Personally, I’ve spent a good amount of time, when presented with the opportunity, to educate my friends, family, extended network and aspiring angel investors, that this is simply not true.

Across the 52 angel investments that I made prior to starting SuperAngel.Fund, my average check size was $13k and median check size was $10k. Oftentimes, new angel investors feel embarrassed to ask a founder or tell a friend that they would prefer to invest a smaller amount into a company. This unfortunately causes them to flex above their comfort zone and invest far more than they otherwise would. And, the reality is far different. In fact, the majority of early stage founders will gladly accept a smaller check than what they publicize. Far too many times I have heard this same story and it really upsets me. After all, one of the biggest mistakes that I see first time angel investors make is to invest too much money into too few companies. The best advice I have is to start small, make more investments than you originally planned for, and put less money into each one than you initially thought to. Over time you will learn and experience so much as there is a very steep learning curve. Each investment will educate, guide and inform you as to what strategies, stages, categories, geographies and industries are best suited for you to invest in, and which approach is aligned with your interests such that you will have a competitive advantage. While the responsibility certainly falls on the individual, I also think that more fund managers and syndicate leaders should do a better job of educating their limited partners (LPs) around this topic.

That being the case, I was really glad to see a recent study from Carta that tracked the distribution of check sizes into early stage rounds based on data from ~19,000 financings. While the results were not particularly surprising to me, I believe they were very surprising to most. In financing rounds under $250k, the median check size was $12.5k. In rounds that raised up to $1m, 18% of the checks were under $10k and 42% were under $25k. Even in rounds that raised up to $5m, 25% of the checks were under $25k.

As the early stage venture market has matured in recent years, more and more people are becoming aware that small checks matter. A lot. And, that they are extremely valuable, more often so than larger checks. The network, introductions, advice and support that smaller investors provide is increasingly appreciated by founders. Additionally, smaller checks often end up leading to much larger checks. These are some of the reasons I have always tried to make SuperAngel.Fund and Super Angel Syndicate as accessible as possible. The value I receive from my network, no matter what their commitment level is, far exceeds the dollars invested.

Blog Updates

During the quarter we featured four of our portfolio companies in the ‘Founder Friday’ newsletter series. Zaid Rahman from Flex, Ben Wunderman from Packsmith, Dipti Desai from Crstl and Will Gahagan from Biom. You can read each of these and prior issues by clicking here.

Towards the end of last year I decided to write more frequently in order to share more timely thoughts and interesting things that I see and hear in my daily role investing in, working with, supporting and advising founders. I plan to keep posting 2-3x per week on LinkedIn and Twitter. Below you can find the latest posts. Feel free to like, comment or share if anything resonates with you, and reach out with any feedback!

Our Approach

Over the past 12 quarters, SuperAngel.Fund has maintained a disciplined, thoughtful and consistent strategy. We have been intentionally conservative with our investable capital and held reserves that are allowing us to benefit from, and take advantage of, this lower-entry-valuation environment that we are in right now. This has enabled our LPs (Limited Partners), to benefit from even more diversification, which increases coverage over a wider timeframe and exposes them to a larger quantity of investments across market cycles. This is a recipe I believe is crucial to achieving long term success and maximizing gains.

As a solo General Partner (GP) that is responsible for all aspects of my fund’s operations, marketing, deal flow pipeline, decision-making, due diligence, investment performance, and portfolio support, I relate much more closely to the founders that we invest in rather than my peer group of professional investors/VCs, or part time angels. As you might imagine, this breeds an extremely unique connection with founders that is hard to quantify. There is a mutual appreciation for building a business from the ground up, having to do more with less, and wearing multiple hats at once. This connection creates a deep trust, loyalty, empathy and friendship which is among our biggest differentiators compared to other capital allocators. I care about the success of my business (e.g. my fund), in a way that only a founder can care about her or his business. Founders know that I live and breathe, win and lose, celebrate and in certain cases fail, right alongside them. It is what drives our deal flow, information advantage, ability to support our network, and more.

There are exceptional entrepreneurs everywhere building exceptional companies and I spend much of my time trying to find them and buy a ticket on their rocket ship. I maintain deep conviction in our fund’s strategy, and believe the market turbulence will continue to work in our favor as we sit on a healthy cash position, ready to take advantage of opportunities. To rearticulate our approach:

Invest as close to the first check as possible

Focus on the categories we know best

Leverage massive network on behalf of portfolio companies to deliver unfair competitive advantage

Champion founders and their companies religiously to drive incremental exposure, customers, and business opportunities

Position ourselves as each founder's favorite and most helpful investor

These attributes result in higher quality and larger quantities of deal flow, one of the most pivotal aspects of any type of investment firm. I also believe that the earlier the stage that one invests (and we invest very early), the more diversification is needed to weather the zeros and optimize the chances of hitting home runs.

As always, the fund has a strong pipeline for new investments and will continue to monitor follow-on or secondary opportunities into existing portfolio companies that show breakout success/growth metrics. If you come across impressive founders looking to raise capital within our areas of focus, I greatly appreciate you sharing those opportunities with me.

Thank you for your ongoing support and confidence. I look forward to updating you again after Q1.

Sincerely,

Ben Zises

PS. You can access all prior quarterly updates at the link here.

Want to invest with SuperAngel?

Join SuperAngelSyndicate.com. Once accepted, syndicate members are invited to review deal memos whenever I have a new investment to share and can choose to invest or pass based on their own discretion. Minimums generally start at $2,500 and priority allocations are given to SuperAngel.Fund LPs on a first-come, first-served basis. Click here to request an invitation to the syndicate.

Join SuperAngel.Fund. Unlike the syndicate, the fund is my primary investment vehicle and provides diversified exposure to every company SuperAngel invests in, one of the most important attributes of a successful early stage portfolio. LPs also receive priority access to co-investments. Click here to request more information on the fund.

Why am I receiving this?

You are receiving this email because you are either a friend, co-investor, associate, or connection of Ben Zises or SuperAngel who at one point expressed interest in receiving updates and other correspondence from me. If you received this email in error, please accept my apologies and feel free to unsubscribe at the link below.

SuperAngel.Fund is an early stage fund led by Ben Zises that invests in Consumer (CPG, eCommerce SaaS), PropTech, & Future of Work. Click here to view our deck.