SuperAngel.Fund x Q2 2024 Recap 🔥

SuperAngel.Fund is an early stage fund that invests in Consumer, PropTech & Future of Work.

Dear Friends,

As always, I am excited to share the 14th(!) quarterly recap for SuperAngel.Fund.

Note, this is the final quarterly series for the SuperAngel rolling fund (which will now be referred to as Fund I). Over the coming months, I will provide more details on the ways in which you can invest with me. In the meantime, if you are not already one of the 2,000+ members of my syndicate, click here to request an invitation. Once accepted, you can learn about new investments that I make and choose to participate deal-by-deal alongside me or pass at your discretion. There is no upfront commitment.

In this letter, instead of sharing general market trends which you can read about in plenty of industry reports, I would rather talk about the investments that we made in Q2, our differentiated strategy, and offer a more detailed analysis of the Fund I portfolio, including its overall performance since inception on January 1, 2021.

Before we dig in, I want to reiterate our success criteria. In venture capital, the top performing managers deliver approximately 20% annualized returns (IRR) over a typical fund’s 10-year life. As such, this is the benchmark that we aim to exceed 🚀.

Over the past 3.5 years, across SuperAngel.Fund & SuperAngelSyndicate.com we have invested more than $20m into 100+ companies on behalf of over 500 Limited Partners (LPs). And we have built one of the leading brands in early stage investing. In this relatively short period of time we have also developed one of the most powerful networks and strongest reputations in the industry.

While it is still very early in the lifecycle of our portfolio, I have never felt more excited about the promise of our investments and the strategy that we are executing (more on that below).

Our goal now is simple: to capitalize on the market position that we have created as a top-tier angel fund and syndicate, in the eyes of both seasoned and aspiring founders, world-class operators, leading venture capital co-investors, and other key stakeholders.

Attaining and maintaining this goal requires a level of focus, discipline and commitment that best matches that which is found in our strongest founders. This “obsession,” as some may describe it, to become the best at one's craft enables us to continue to be invited to invest in the best companies, at the earliest stages, alongside the most sought after capital allocators.

Ultimately, the only way to accomplish these goals is to deliver LPs consistent above-market returns over the long term.

And, as many of you know, I pursue these goals whilst offering an even greater level of transparency, accessibility and communication than LPs might otherwise be accustomed to.

As a solo General Partner (GP) responsible for all aspects of the fund, I relate much more closely to the founders that we invest in rather than other professional investors/VCs, or part time angels. This breeds an extremely unique connection with founders that is hard to quantify. There is a mutual appreciation for building a business from the ground up, having to do more with less, and wearing multiple hats at once. This connection creates trust, loyalty, empathy and friendship which is among our biggest differentiators. I care about the success of my business (e.g. the fund), in a way that only a founder can care about her or his business. Founders know that I live and breathe, win and lose, celebrate and in certain cases fail, right alongside them. It is what drives our deal flow, information advantage, ability to support our network, and more.

While many of the companies in our portfolio are just getting started, several have already begun to show signs of breakout success and “fund returning” potential. And, while it may be a few years before we realize the value of these investments, it is encouraging to see many early data points trending in our favor.

As SuperAngel.Fund I is now fully deployed I will continue to issue investor updates on a regular basis, however, you can always follow me on LinkedIn, Twitter/X and my newsletter/blog, where I regularly share thoughts on our industry, highlight portfolio companies, publicize new financing events, share podcast interviews and promote founder meetups.

SuperAngel.Fund I - Q2 2024 Investments

During the second quarter, we made 23 investments with a median check size of $50k and post-money valuation of $10.8m. Our investments were spread across Consumer (11), eCommerce SaaS (9), and PropTech/Future of Work (3).

Grocers List: Growth platform for recipe creators

Gamify: All-in-one SaaS platform for field sales teams

Candidate.fyi: Candidate experience platform

Caspian: Global trade & duty optimization

AccelPay: Powering eCommerce for alcohol brands

Big Company: Intelligent brand communications platform

Fox Fold: Sustainable tissue solutions for hotels

BinStar: Bargain store turning returns into treasures

TVAds AI: Performance TV marketing for brands

Intelligems: Revenue optimization tools

Sylvie: Marketplace for vintage & antique furnishings

Wally: The future of dental care

Create: The first modern creatine brand

Jack: AI-powered house manager for homeowners

Siena: AI customer service designed for commerce

Magna: Magnesium powered hydration

Quite Nice: Food-as-medicine gut health brand

Cosign: Bridging the gap for renters and property managers

Frate: Returns management & optimization

Otis (Pending): A better way to get veterinary care

Happy Medium (Pending): Modern arts club for casual artists

Confidential: Stealth 🤐

SuperAngel.Fund I - Performance Summary

Since the fund started in January 2021 we have deployed $10.2m across 198 investments into 127 companies. I estimate the current value to be $13.7m which represents a 15.56% unrealized IRR and 1.35x gross multiple. So far, 82 investments have seen a markup, 97 are active and 19 are no longer active.

SuperAngel.Fund I - Portfolio Highlights, Insights & Analysis

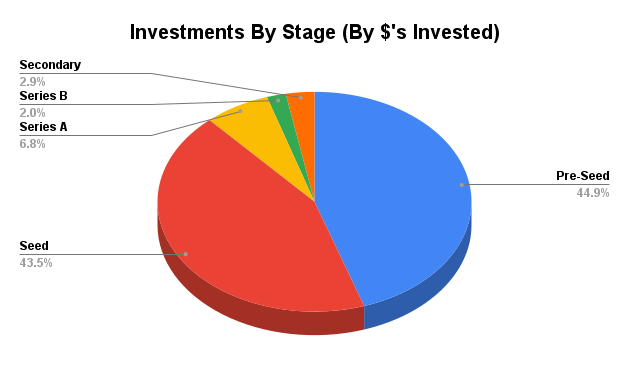

Below are a number of charts that showcase more visually the fund’s composition and attributes. We will continue to share more data, insights and analysis from the portfolio as it matures.

Also below [Redacted] is a partial list of companies in Fund I that have raised follow-on funding since our initial investment, and which have already started to showcase a high degree of upside potential. Additionally, there are a number of others that are similarly performing well but have not needed to raise more capital and therefore not yet considered a “marked up.”

One aspect to investing in venture capital funds is that oftentimes the most meaningful financial returns come from just a small number of investments. While I believe this has a reasonable likelihood of being true in our case, I also hold the belief that we will have more than a handful of sizable winners. Time will tell.

Of a particular note, 48% of the Fund’s portfolio companies had at least one underrepresented founder, and 34% included at least one female founder. We believe that these attributes in particular will prove to be very positive drivers of the future success of our portfolio.

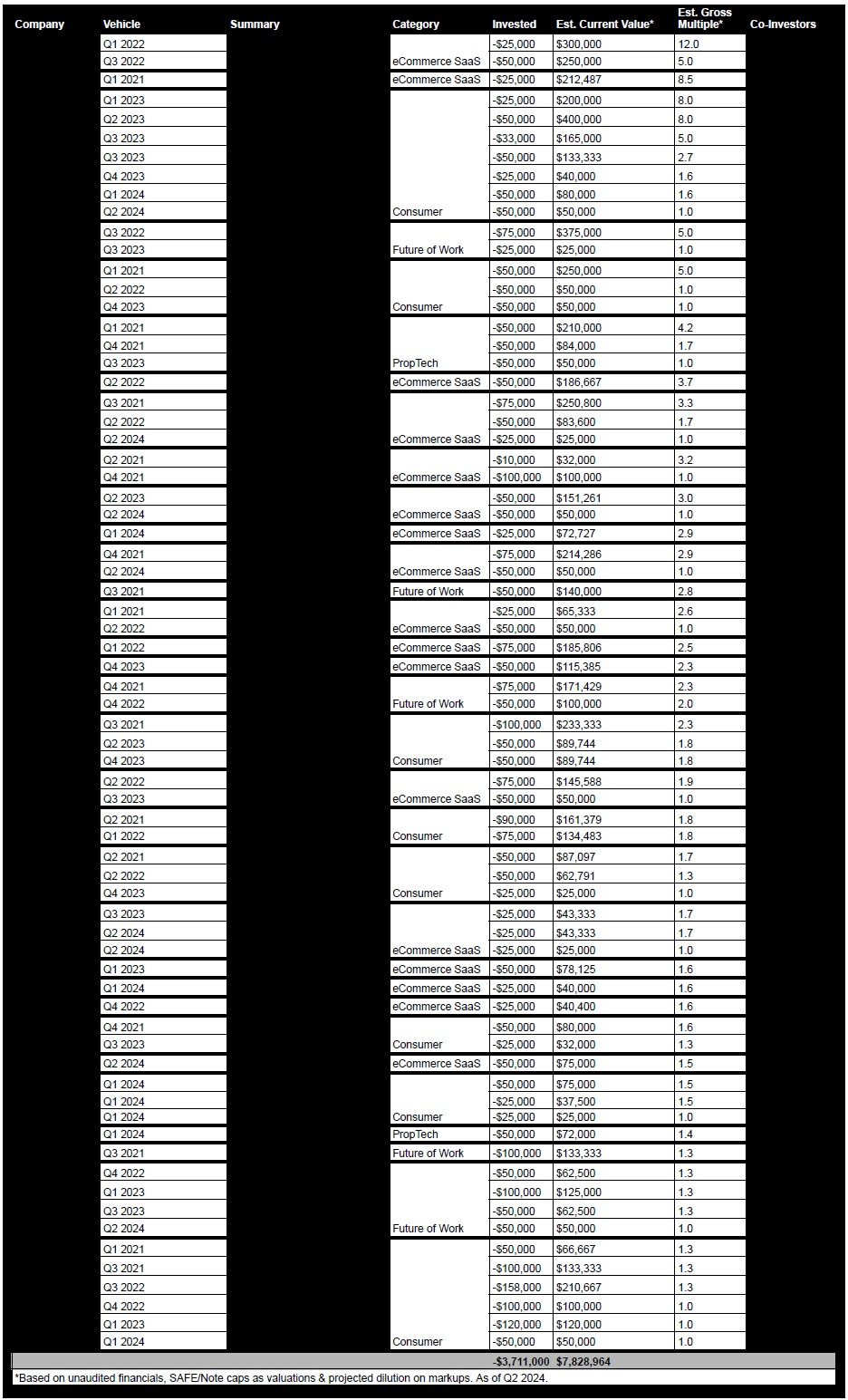

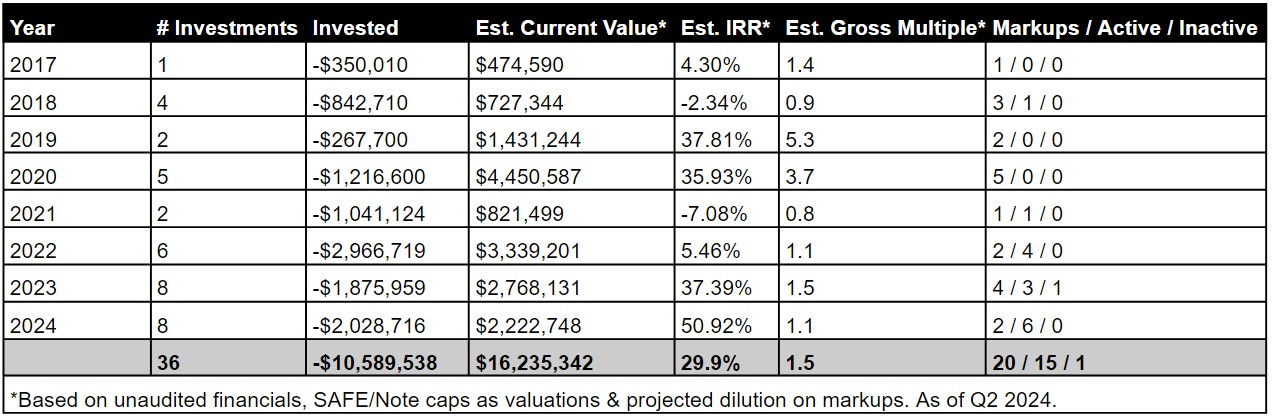

SuperAngelSyndicate.com - Performance Summary

In addition to the fund, SuperAngelSyndicate.com provides an opportunity for LPs to contribute more, from time to time, into individual companies via special purpose vehicles (SPVs). The syndicate has deployed $10.5m across 36 investments into 19 companies. I estimate the current value to be $16.2m which represents a 29.9% partially realized IRR and 1.5x gross multiple. So far, 20 investments have seen a markup or distribution event, 15 are active and one is no longer active.

Across the entire SuperAngel portfolio combined, we have deployed $21.2m across 277 investments into 146 companies. I estimate the current value to be approximately $33.6m which represents a 19.48% IRR and 1.58x gross multiple.

Overall Investment Strategy

Our investment strategy is best summarized by a recent post written by Fred Wilson, Co-founder of Union Square Ventures and widely considered to be one of the greatest early stage VCs of all time:

“Early stage venture investing is like poker. You make a small initial investment, which is like the ante in poker, and you get a seat at the table. Then you watch the founder and team execute until they need more money. That is like the first set of cards you get. Then you get the chance to invest more money. That is like putting more chips on the table. This repeats a few more times and eventually the company succeeds or fails. That’s like the river and the reveal.”

In short, we invest as close to the first check as possible, maintain particularly deep ties to our founders and their companies as they evolve, and look to double-down or more when the right opportunity presents itself.

As the SuperAngel portfolio has developed, more of my time is spent meeting with our companies to support them in whatever ways they need. Since the vast majority continue to operate and thrive, I do this to help them grow even faster and more efficiently. Founders confide in me. They share the most nuanced details on what is working, what is not working, and how we can help. I am often the first to know when a new customer is signed, if a record sales quarter is underway, which new products are being launched, or when a game-changing distribution partnership is in the works.

I leverage all my relationships, including those I have with you, and the wider network that we have built, to introduce founders to additional sources of capital, lighthouse customers and potential new hires. While many investors claim to offer similar levels of service and value, SuperAngel aspires to deliver even more. After all, our fund is named “SuperAngel” for a reason 😇. What excites me the most right now is staying close to these founders, continuing to share in their ups, downs, wins and losses, over what may be another decade or more of a journey that they are on. As we all know, the very best things (and returns) in life take time.

As a result of our strategy and the success that we have had executing on it so far, we are privy to private information about our companies far beyond what typical investors get access to. It would be difficult for others to replicate what we do at scale, let alone at all. Just like all investors hope to do, we are leaning into these competitive advantages that we have gained. In surveying the landscape between making net new investments and doubling down on some of our existing ones, it has become increasingly clear that many of our most promising opportunities are right in front of our eyes: Follow-ons into existing portfolio companies.

“One of the great things about our industry is it is based on inside information…in fact the whole name of the game is to have information asymmetry.” -Jason Calacanis

“The most important thing that fund managers get wrong is not having appropriate reserves for your winners. And, if I look back, the real profit dollars that I leaked was not investing enough upfront but when I didn’t have enough reserves to do the full pro-rata or even super pro-rata in the ones that worked.” -Chamath Palihapitiya

As I wrote in the 2023 Year-End Update, “If I am doing my job right the first time in ‘picking winners’, at least for a few subsequent rounds, our best deal flow should come from our existing portfolio.”

While I continue to receive hundreds of new pitches on a weekly basis, evaluating each one on its own merits and continuing to make net new investments, there are tremendous advantages to reinvesting in the companies we already know. The key, of course, is to be extra discerning over which ones. This strategy requires me to monitor our portfolio closely, keep in constant contact with our founders, and understand which ones are meeting, exceeding or blowing away their performance targets.

As another benefit to follow ons, oftentimes startups are willing to maintain their previous round valuation when taking capital from existing investors. Part of the reason for this is the increased speed in ‘insider’ led financings. As each party is already familiar with the other, much of the due diligence has already been completed. This creates a favorable situation for all sides. And, while some of the best companies are not proactively taking more capital, insiders can preemptively create an opportunity that did not previously exist. For investors like us, founders are often willing to take our capital at any time since they consider our dollars as “strategic.” This is because of the signal of having SuperAngel on their cap table along with the support we lend and reputation we hold.

When we invest in a company we are familiar with, we benefit from ‘insider’ information and a pre-existing relationship to the founders. In these cases, we have the luxury of watching teams execute through ups and downs over an extended period of time. These historical data points provide a meaningful advantage over outsiders who don’t have this context, and who may not even be aware that the investment opportunity exists! After all, a key ‘perk’ to investing in private companies is to capitalize on information that the general public may not know. That is the case with follow ons.

Below are a few posts written by other early stage investors that I admire and which concisely sum up our investment strategy:

Given the macroeconomic conditions which have caused a massive drop in venture dollars available, founders need to compete more than ever for limited investment dollars. This, in turn, creates a phenomenal “buying” opportunity which we seek to continue to capitalize on.

Our Approach

Over the past 14 quarters, SuperAngel.Fund has maintained a disciplined, thoughtful and consistent strategy. We have been intentionally conservative with our investable capital allowing us to benefit from, and take advantage of, the lower-entry-valuation environment that we have been in over recent quarters. This has enabled our LPs to benefit from even more diversification, which increases coverage over a wider timeframe and exposes you to a larger quantity of investments across market cycles. This is a recipe that I believe is crucial to achieving long term success and maximizing gains.

There are exceptional entrepreneurs everywhere building exceptional companies and I spend much of my time trying to find them and buy a ticket on their rocket ship. I maintain deep conviction in our fund’s strategy, and believe the market turbulence will continue to work in our favor. To rearticulate our approach:

Invest as close to the first check as possible

Focus on the categories we know best

Leverage massive network

Ruthlessly champion the founders we support and their companies

Offer a deep level of empathy, trust, dedication and loyalty to founders with hopes of being their favorite and most helpful investor

These attributes result in higher quality and larger quantities of deal flow, one of the most pivotal aspects of any type of investment firm. We also believe that the earlier the stage that one invests (and we invest very early), the more diversification is needed to weather the zeros and optimize the chances of hitting home runs.

As always, the fund has a strong pipeline for new investments and will continue to monitor follow-on or secondary opportunities into existing portfolio companies that show breakout success/growth metrics. If you come across impressive founders looking to raise capital within our areas of focus, I greatly appreciate you sharing those opportunities with me.

Thank you for your ongoing support and confidence. I look forward to updating you again soon.

Sincerely,

Ben Zises

PS. You can access all prior quarterly fund updates at the link here.

Want to invest with SuperAngel?

Join SuperAngelSyndicate.com. Once accepted, syndicate members are invited to review deal memos whenever I have a new investment to share and can invest or pass at their discretion. Minimums generally start at $2,500 and priority allocations are given to SuperAngel.Fund LPs on a first-come first-served basis, with no upfront commitment. Click here to request an invitation to the syndicate.

Join SuperAngel.Fund. Unlike the syndicate, the fund is my primary investment vehicle and provides diversified exposure to every company SuperAngel invests in, one of the most important attributes of a successful early stage portfolio. LPs also receive priority access to co-investments. Click here to request more information on the fund.

Why am I receiving this?

You are receiving this email because you are either a friend, co-investor, associate, or connection of Ben Zises or SuperAngel who at one point expressed interest in receiving updates and other correspondence from me. If you received this email in error please accept my apologies and feel free to unsubscribe at the link below.

SuperAngel.Fund is an early stage fund led by Ben Zises that invests in Consumer (CPG, eCommerce SaaS), PropTech & Future of Work.