SuperAngel.Fund x Q1 2025 Recap 🔥

SuperAngel.Fund is an early-stage fund led by Ben Zises that invests in Consumer, PropTech & Future of Work.

Dear Friends,

I am pleased to share the Q1 2025 update for SuperAngel.Fund.

As mentioned in our last update, Fund I is now fully deployed. For those keeping track, Fund I consists of 14 quarterly vehicles structured as a rolling fund. Ours started in Q1 2021 and ended Q2 2024. LPs who participated had exposure to all investments made throughout the quarters in which they subscribed to, or which they gained exposure to as a result of rollover capital. You can view a list of Fund I companies by selecting the ‘Fund I’ filter on the portfolio section of our new website (H/T BX Studio!)

Stay tuned for details on Fund II next week 👀

Fund I Performance Summary

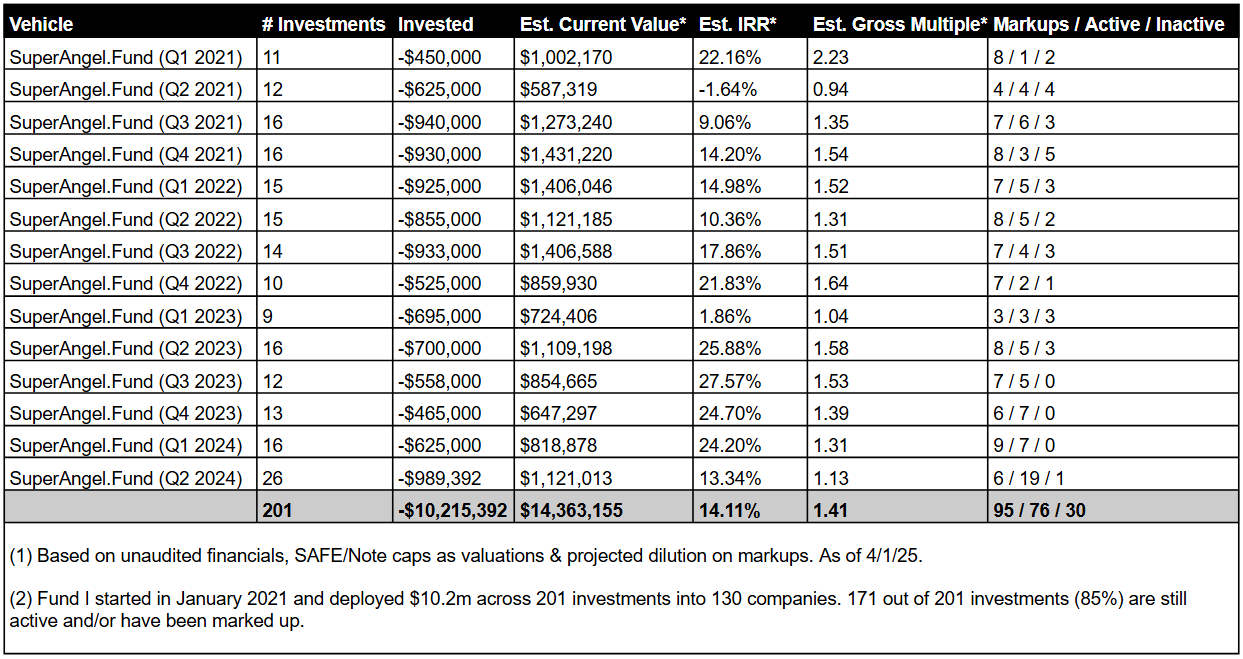

Fund I started in January 2021 and deployed $10.2m across 201 investments into 130 companies. I estimate the current value to be $14.36m which represents a 14.11% IRR and 1.41x gross multiple on invested capital. Of note, 171 out of 201 investments (85%) are still active and/or have been marked up.

As you probably know, it is often the unsuccessful companies that generally present themselves in the early years of a fund’s life, with the winners coming towards the end. And while it is still rather early in the life of Fund I, I feel confident that we will have a number of winners over time. Upon the receipt of distributions from liquidity events such as M&A, tender offers, secondary sales, IPOs, etc., capital will be returned to LPs.

Fund I Highlights & Strategy

You can read more about our investment strategy on our website. And, I recently published two LinkedIn posts which also describe our differentiated strategy and the innovations in VC that have allowed us to execute it.

Here are a few examples:

Create: The first modern creatine brand

SuperAngel.Fund was one of the earliest investors in Create, a modern creatine brand, after the founder, Dan McCormick, reached out to me directly in June 2022 (six months before launch). Creatine has become one of the fastest growing products in the Vitamin, Minerals and Supplements (VMS) category and Create is well on its way to becoming the leading brand in the space. Click here to see a recent clip from the Joe Rogan Podcast where he talks about his creatine usage and gives an unpaid promotion of the brand. Fund I invested in Create several times over an 18-month period as the business started to show breakout performance and growth metrics. Most recently, the company announced their $5m Series A round led by Unilever Ventures.

Motion: Creative analytics platform that enables brands to make more successful ads

Fund I first invested in Motion in 2022. Similar to what happened with Create, Reza Khadjavi, the founder, also reached out to me directly after noticing that I was an investor in several of his customers. Motion's platform helps brands determine which of their creative assets perform best across each of their respective marketing channels, enabling more data-centric decision making across the organization. After watching Reza and his team execute and grow the business over the months that followed our initial investment, we followed on with another investment in their Seed round. The business has grown dramatically from the early days and most recently announced their $30m Series B round led by Innovia, one of Canada’s largest venture capital firms.

Other Updates Across the Portfolio

Below is a selection of other public updates across the Fund I portfolio.

Consumer

Arber: Lawn, garden & plant care brand (Launched new Ready To Spray Collection)

Bandit: Community driven running brand (Opened new LA store)

Biom: The world’s first refillable, biodegradable wipe system (Launched in Target)

Branch: Office furniture that works (Launched new Ergonomic Chair Pro)

Brightland: Wholesome olive oils, vinegars & honey (Launched MacKenzie-Childs holiday collaboration)

Cadence: Next generation travel products (Launched second major product line, The Parcel, as an innovative take on the toiletry bag)

Caraway: Cookware without the chemicals (Named One of America’s Moved Loved Brands by Newsweek)

Cleancult: All-natural household cleaning products (Expanded on their recent Walmart launch with other major mass retail launches coming later this year)

Create: The first modern creatine brand (Raised $5m Series A from Unilever Ventures)

EIGHT Brewing Co.: Light beer, made right (Troy Aikman led new funding round)

Kanpai Foods: The next great candy brand (Expanded retail presence with Target launch)

Kimai: Fine jewelry that doesn’t cost the earth (Opened new stores in London & LA)

Lalo: A modern baby & toddler brand built for today’s families (Launched large assortment of products in Target with premier end cap displays)

Otis: Accessible & affordable care for pets and owners (Stay tuned for updates 👀)

Rorra: Tap into clean water (Launched their first product, the Countertop System, to tackle the tap water crisis in America)

Sylvie: Marketplace for vintage & antique furnishings (Partnered with Bridgerton star Phoebe Dynevor to launch first celebrity collection)

Windmill: Smart ‘air care’ products & technology (Expanded into new category with Air Purifier)

eCommerce SaaS / Consumer Tech

Accelpay: Powering eCommerce for Alcohol brands (Expanded internationally across UK, European Union)

Adgile: Tech-enabled out-of-home media company (Achieved record sales in 2024 and launched case studies with new advertising client partners)

Archive: AI-first influencer marketing platform (Launched AI-powered campaign dashboards)

Caspian: Trade advisory & tariff optimization platform (Raised Seed round led by Primary VC)

Crstl: B2B commerce network powered by AI (Raised Series A led by Mosaic, Cohen Circle, & Shopify Ventures)

Disco: AI-powered retail media network for brands (Reached $20m run rate and achieved 340% YoY growth in 2024)

Grocers List: Growth platform for recipe creators (Announced Pre-Seed round led by Founder Collective and Impellent VC)

Highbeam: Finance platform for eCommerce businesses (Launched the first AI finance agent for consumer brands)

Intelligems: Profit optimization platform (Raised $9m Series A led by Stage 2 Capital)

Minoan: Furnishing and monetization platform for short-term rental hosts (Launched new marketing website, onboarding experience, Shopify App and more)

Motion: Creative analytics platform (Raised $30m Series B led by Innovia)

Orita: AI / ML marketing optimization for brands (Launched their second product for direct mail in partnership with PostPilot, another Fund I portfolio company)

PostPilot: Direct mail platform for eCommerce brands (Raised Series A led by Summit Partners and Klaviyo founders)

Settle: Financial operating system for brands (Launched in the Shopify App Store)

Siena: AI customer service platform for brands (Launched Siena Academy, first AI certification for CX leaders)

Superfiliate: All-in-one influencer, affiliate, and creator platform (Launched Automations to enable brands to automate their entire influencer management program and processes)

Two Boxes: eCommerce returns processing platform (Raised $5.4m funding round led by Peterson Ventures)

With Coverage: All-in-one risk management platform for brands (Stay tuned for updates 👀)

PropTech

Cosign: A better rental guarantor platform (Stay tuned for updates 👀)

Flex Storage: Digital solutions for physical storage & moving (Expanded from Florida into Texas, Georgia, Tennessee, Arizona, North Carolina)

Rove: Marketplace and property management for luxury rentals (Stay tuned for updates 👀)

Olive: AI-powered booking engine for hotels (Announced major partnership with Stayntouch, a leading PMS for independent hotels)

Minoan: Furnishing and monetization platform for short-term rental hosts (Launched new marketing website, onboarding experience, Shopify App & more)

It’s electric: EV charging built for cities (Raised $6.5m Seed round led by Failup Ventures & Uber)

Future of Work

Candidate.fyi: The candidate experience platform (Closed multiple public companies as customers, released multiple new product features including AI-powered scheduling)

Flex: All-in-one finance platform for SMBs and their owners (Raised $25m Series B round led by Titanium Ventures)

Home From College: Career home-base built for Gen Z (Raised $5.4m Seed round led by Google Ventures)

Jolly: Workforce recruiting & retention platform (Raised $16.5m Series A led by former Tesla CFO Zach Kirkhorn)

Paiv: Field-sales platform built for the trades (Launched new website and rebranded to Paiv)

Thank you for your ongoing support and confidence. I look forward to updating you again soon.

Sincerely,

Ben Zises

SuperAngel.Fund is an early-stage fund led by Ben Zises that invests in Consumer, PropTech & Future of Work.

Stay tuned for details on Fund II next week 👀

From our Blog…

Why am I receiving this email?

You are receiving this email because you are either a friend, co-investor, associate, or connection of Ben Zises or SuperAngel, who at one point expressed interest in receiving updates and other correspondence from me. If you received this email in error please accept my apologies and feel free to unsubscribe at the link below.

SuperAngel.Fund is an early-stage fund led by Ben Zises that invests in Consumer, PropTech & Future of Work 😇.