SuperAngel.Fund x Q1 2024 Recap 🔥

SuperAngel.Fund is an early stage fund that invests in Consumer (CPG, eCommerce SaaS), PropTech & Future of Work.

Happy Friday!

As always, I am excited to share the quarterly recap for SuperAngel.Fund.

During the quarter we made 13 investments with a median check size of $50k and post-money valuation of $11.9m. Our investments were spread across Consumer (6), eCommerce SaaS (5), and PropTech (2).

Since the fund started in January 2021, we have deployed $9.2m across 175 investments into 114 companies. I estimate the current value to be $11.5m which represents a 13.4% unrealized IRR and 1.25x gross multiple. So far, 61 investments have seen a markup, 100 are active and 14 are no longer active. Click here to view a detailed performance summary.

In addition to the fund, SuperAngelSyndicate.com provides an opportunity for LPs to contribute more, from time to time, into individual companies via special purpose vehicles (SPVs). The syndicate has deployed $8.8m across 29 investments into 18 companies. I estimate the current value to be $13.2m which represents a 15.8% partially realized IRR and 1.50x gross multiple. So far, 19 investments have seen a markup or distribution event, nine are active and one is no longer active.

Across my entire angel, fund and syndicate portfolio combined, I’ve deployed $18.4m across 247 investments into 133 companies. I estimate the current value to be approximately $27.2m which represents a 17.96% IRR and 1.48x gross multiple.

Q1 2024 Investments

Rorra: The future of water filtration

Character: The most helpful home improvement brand on the planet

Olive: Modern eCommerce stack for hotels

Adgile: Tech-enabled OOH advertising

Drivepoint: Strategic finance platform for consumer brands

Create: The first modern creatine brand

Orita: Machine learning automation for eCommerce

Revenue Roll: Adtech platform to increase sales conversions

Kanpai Foods: Freeze dried candy brand

With Coverage: Risk management platform for brands

Arber: All natural lawn, garden and plant care brand

its electric: EV charging built for cities

Provenance: Digital tools for life’s milestone moments

Market Commentary

This past quarter was characterized by cautious optimism, a sense of bottoming out with hope for a soft economic landing, regional shifts in where founders are deciding to build startups, peak investor friendliness, and other trends. See below for a few worthwhile takeaways.

VC Activity ⬇️

The first quarter of 2024 was relatively slow from a deal count, fundraising and exit perspective. $36.6B was invested across 3,925 deals according to Pitchbook and the National Venture Capital Association (NVCA). This was in line with the same period last year but far below the peak of $97.5B invested in Q4 2021 and 5,466 deals closed in Q1 2022. There were 300 exits this quarter with a total value of $18.4B as compared to the 543 exits peak in Q4 2021 and $269B of exit value peak in Q2 2021.

According to the report, Q1 2024 reflected the lowest fundraising volume in the past decade for VC with a total of $9.3B in newly committed capital to funds, representing just 5% of the 2022 annual high. With little capital to recycle into the market from a dearth of liquidity, LPs have come under further pressure in navigating their exposure to venture. The report categorizes the current climate as defensive, evidenced by the reduction in activity and investor’s “focus on their existing portfolio companies in the face of relative abundance of demand and opportunities for new investments.” It continues “insider-led rounds are currently more common than they have been in years, and first-time financings are at multi year lows…Investors seem to be circling their wagons and making sure their most promising companies are positioned for success before they make new bets.”

At SuperAngel.Fund our experience and activities mirror these findings. We are investing heavily into our most promising companies and spending significant time making sure they are well-positioned to succeed. And, we are doing so at extremely attractive valuation levels relative to what we would have paid in prior periods or during different market cycles. As I wrote in my last quarterly report, we continue to receive hundreds of new pitches on a weekly basis, evaluating each one on its own merits and continuing to make net new investments. However, there are tremendous advantages to reinvesting in the companies we already know. The key, of course, is to be extra discerning over which ones. This strategy requires me to monitor our portfolio closely, keep in constant contact with our founders, and understand which ones are meeting, exceeding or blowing away their performance targets. We are often privy to private information about our companies far beyond what typical investors get access to. This includes unique insights and a perspective that is, quite frankly, unmatched. In surveying the landscape between making net new investments and doubling down on some of our existing companies, it has become increasingly clear that many of our most promising opportunities are right in front of our eyes. After all, a key ‘perk’ to private market investing is to capitalize on ‘private’ information that the general public may not know. That is the case with follow ons. With less capital accessible compared to prior years, founders need to compete more than ever for investor dollars. This, in turn, creates a phenomenal buying opportunity which we seek to capitalize on.

This past quarter was also regarded as one of peak “investor friendliness”. After an extended period of founder leverage, Q1 hit an all time high in the other direction. From the Pitchbook and NVCA report, “We have noted the increase in down rounds during recent quarters, but share price has not been the only compromise by founders. Investors have increasingly added downside protective terms, such as cumulative dividends and liquidity multiples into term sheets, enabled by the lower investor competition and the increased competition on the company demand side. In contrast to the manic market of 2021, investors now have more choice. Benchmarks for deals have increased, and stronger companies are able to compel investment, while struggling companies are likely facing final judgment…In line with what we saw across the venture lifecycle, investors have become cautious and selective when doing deals, and the bar has gone up. Regardless of the ways in which VCs diligence deals, the criteria has become more stringent, and investors prefer to either double down on the best performing portfolio companies or invest in the highest-quality companies that have demonstrated traction and product-market fit. This wariness has also translated into an increase in extension rounds.”

During the quarter there was a slight increase in valuations across several stages, however, investors still remain cautious to deploy capital largely due to a perceived lack of exit opportunities and an overwhelming “wait and see” approach from many funds. However, there is plenty of capital in the market with investors sitting on over $300B of dry powder as a result of years of strong fundraising combined with low levels of investment in recent quarters. Despite a slow start to the VC market in 2024, the quantity and quality of founders building companies does not seem to be slowing down.

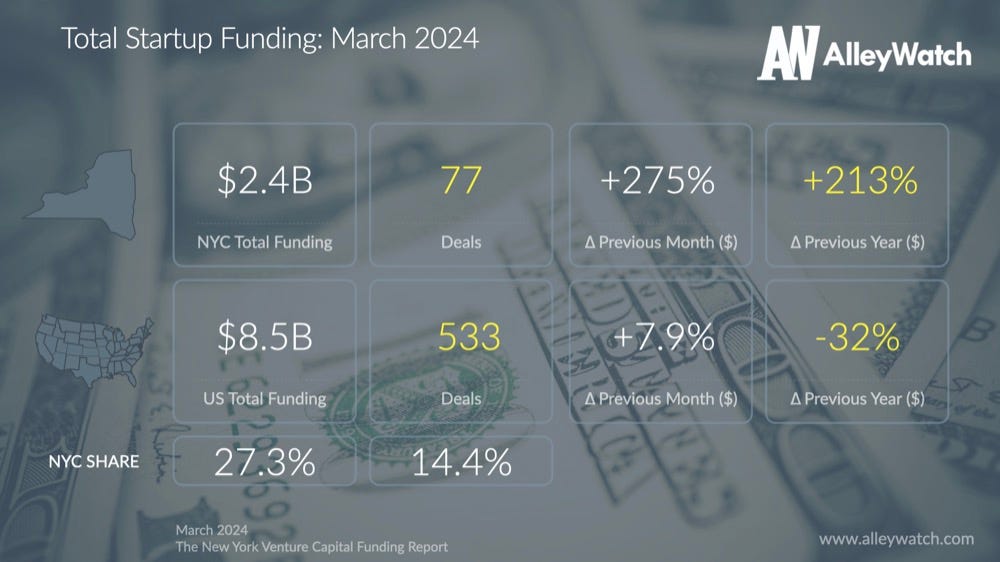

More Founders in NYC 🗽

The San Francisco Bay Area has historically been known as THE global technology hub, attracting the world's best founders that have fostered an unparalleled ecosystem. However, the tides may be shifting East. According to a survey of 7,500 founders from Live Data Technologies, New York City saw the most new founders in Q1 2024 (chart below). Recently, there has been major growth in venture allocation to startups based in NYC, so the reality that more founders want to move here is no surprise. AlleyWatch also reported $2.4B in funding to NYC startups in March 2024 representing a 213% increase YoY and accounting for 27% of startup funding nationally. Per Pitchbook’s Regional Spotlight (page 17), NYC closed 75% of the number of deals that the Bay Area did in the first quarter (427 vs. 570), and NYC is the only ecosystem other than the Bay Area with funds that closed more than $1B so far in 2024. In a post-COVID world, one trend we do not see changing is that great companies can start and operate anywhere. While we don’t expect the Bay Area to lose the top position, NYC has established itself as a very close second.

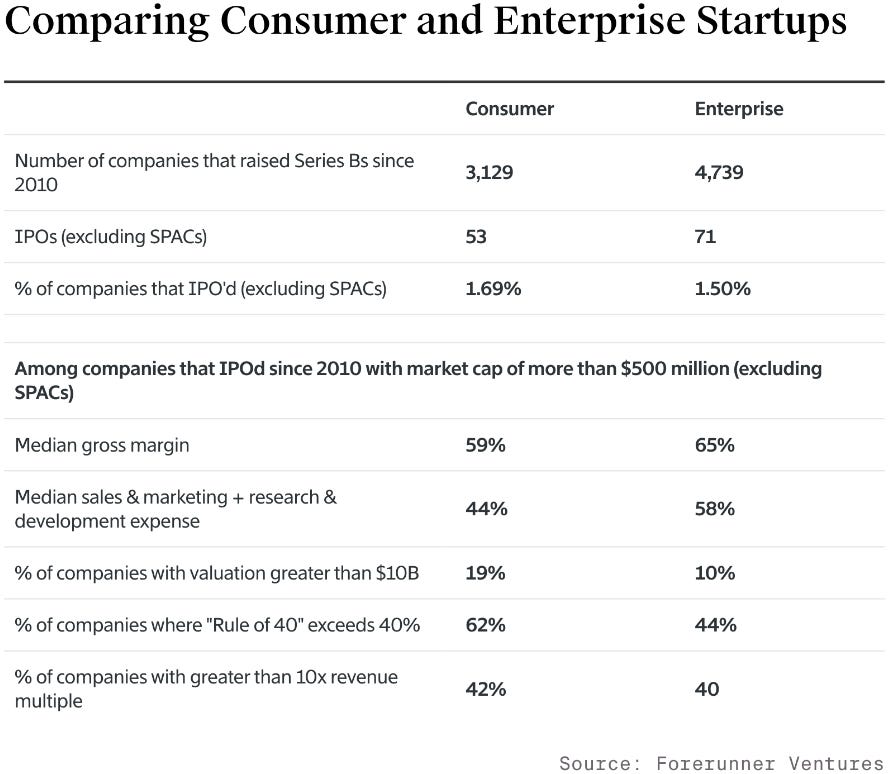

Consumer Startups Are a Better Bet Than Enterprise 🛒

One particularly insightful article that I read this quarter was published in The Information by my friends at Forerunner Ventures. Their analysis found that, contrary to popular belief, consumer companies are more likely to go public at higher valuations than enterprise-focused companies and offer better margins and growth rates. The authors define consumer companies as businesses “where either an individual consumer pays for the service or product or the company’s revenue relies on consumer spend or engagement.” This includes companies ranging from eCommerce and digital brands to service and commerce enablement. In their study of more than 7,800 startups, they found that “compared with enterprise software companies, consumer companies are more likely to go public after raising a Series B, more likely to drive efficient growth at the time of an initial public offering and just as likely to trade at 10 times revenue at the time of IPO.” Of the 3,129 venture-backed consumer companies studied, 1.69% went public compared with 1.50% of the 4,739 enterprise companies (excluding SPACs). And, consumer companies go public at a 13% higher rate and at higher valuations. 18.8% of the consumer companies who went public did so at greater than a $10B valuation and at a median 76 months from founding. This compared to just 9.6% of enterprise companies that went public above a $10B valuation, and a median of 78 months from founding, with consumer companies achieving a 51% higher valuation. For investors, these are notable data points and reflect that consumer companies often have a much larger market share at IPO than their enterprise counterparts.

The article also mentions how AI applications for consumer companies can help reduce both churn and increase revenue. We are investing in brands that utilize a modern tech stack, which includes AI tools, and software businesses that leverage AI and are purpose built for consumer companies. While prominent VCs such as Andreessen Horowitz and Lerer Hippeau have downsized their consumer investing teams, I am extremely bullish on the sector and believe massive gains will be had by those with patience, access to the best deal flow, and an eye for talent. As consumer spending accounts for two thirds of the U.S GDP, we will continue to double down on the sector and enjoy the benefits of more favorable valuations brought on by other players leaving the market.

Seed Valuations & Round Sizes Increase ⬆️

After 2021 saw a record amount of investment into startups with sky high valuations, many in the industry thought it would be long before we saw valuation figures increase again at any stage. However, according to Carta’s First Cut - State of Private Markets Report, the median cash raised by seed stage startups increased from $3m in Q3 2023 to $4m in Q1 2024, surpassing the 2021 highs of $3.8m. In addition, seed stage pre-money valuations increased from $12.8m in Q4 2023 to $13.3m in Q1 2024. As startups are forced to build more value earlier in their life cycle due to a more challenging fundraising environment, for the companies that are able to raise, I believe we will see valuations at the earliest stages start to increase slightly.

Smaller Funds Outperform Larger Funds 📈

A recent article from Axios based on a study from Sante Ventures found that smaller venture funds are more likely to generate a 2.5x return than larger funds. Chart 1 below shows that funds between $0-50M make up a significant percentage (27%) of all funds that return at least 2.5x to their LPs. It is a common misconception that the larger funds see higher returns. In reality, it is much more difficult to generate outsized returns with a large fund than with a small fund because you must have far more winners. From the report, “Venture is a power law business; one winner can return a fund many times over. Ideally you have two, three, four big winners. The better investment strategy is to accept the historical average as a fixed constraint and limit portfolio companies to only the subset of high-quality projects whose capital requirements are relatively low yet generate attractive multiples on average exit values.” Overall, smaller funds present a unique opportunity to generate higher returns as partners and associates of these funds pay a high level of attention to each portfolio company and maintain strong relationships with founders to help grow the business together. This quote from an RBCx blog post puts it extremely well: “Small or micro-VC funds are often lauded for their operational efficiencies. Their nimbleness facilitates swift investment decisions, enabling them to seize market opportunities that might elude their larger counterparts. As a VC fund scales, there’s a risk that overexpansion could potentially dilute the brand’s essence, compromising the quality of investments and partnerships, and thereby diminishing its competitive prowess. This gives rise to an intriguing proposition: might specialized, niche-focused managers, armed with in-depth sectoral insights, trump their more generalized peers in delivering value? In a market cycle (such as today’s), whereby capital is concentrated in only the best and brightest founders, VCs must ensure their thesis is one that not only resonates with their LPs, but also with startup founders who ultimately choose them.” These are precisely the attributes that define us at SuperAngel.Fund.

Blog Updates

During the quarter we featured two portfolio companies in our ‘Founder Friday’ newsletter. And, towards the end of last year I decided to write more frequently to share timely thoughts and interesting things that I see and hear in my daily role investing in, working with, supporting and advising founders. Below you can find link to my latest posts. Feel free to like, comment or share if anything resonates with you!

Our Approach

Over the past 13 quarters, SuperAngel.Fund has maintained a disciplined, thoughtful and consistent strategy. We have been intentionally conservative with our investable capital and held reserves that are allowing us to benefit from, and take advantage of, this lower-entry-valuation environment that we are in right now. This has enabled you, our LPs (Limited Partners), to benefit from even more diversification, which increases coverage over a wider timeframe and exposes you to a larger quantity of investments across market cycles. This is a recipe that I believe is crucial to achieving long term success and maximizing gains.

As a solo General Partner (GP) that is responsible for all aspects of our fund’s operations, marketing, deal flow pipeline, decision-making, due diligence, investment performance, and portfolio support, I relate much more closely to the founders that we invest in than my peer group of professional investors/VCs, or part time angels. As you might imagine, this breeds an extremely unique connection with founders that is hard to quantify. There is a mutual appreciation for building a business from the ground up, having to do more with less, and wearing multiple hats at once. This connection creates a deep trust, loyalty, empathy and friendship which is among our biggest differentiators compared to other capital allocators. I care about the success of my business (e.g. our fund), in a way that only a founder can care about her or his business. Founders feel that I live and breathe, win and lose, celebrate and in certain cases fail, right alongside them. It is what drives our deal flow, information advantage, ability to support our network, and more.

There are exceptional entrepreneurs everywhere building exceptional companies and I spend much of my time trying to find them and buy a ticket on their rocket ship. I maintain deep conviction in our fund’s strategy, and believe the market turbulence will continue to work in our favor as we sit on a healthy cash position, ready to take advantage of opportunities. To rearticulate our approach:

Invest as close to the first check as possible with deep conviction

Focus on the categories we know best and where we have an informational, educational, access or network advantage

Leverage massive network to bring in other strategic capital, operational, sales and team building support

Champion founders and their companies religiously to drive incremental exposure, customers, and business opportunities

Maintain founder empathy, dedication and loyalty to become their favorite and most helpful investor

These attributes result in higher quality and larger quantities of deal flow, one of the most pivotal aspects of any type of investment firm. We also believe that the earlier the stage that one invests (and we invest very early), the more diversification is needed to weather the zeros and optimize the chances of hitting home runs.

As always, the fund has a strong pipeline for new investments and will continue to monitor follow-on or secondary opportunities into existing portfolio companies that show breakout success/growth metrics. If you come across impressive founders looking to raise capital within our areas of focus, I greatly appreciate you sharing those opportunities with me.

Thank you for your ongoing support and confidence. I look forward to updating you again after Q2.

Sincerely,

Ben Zises

PS. You can access all prior quarterly fund updates at the link here.

Want to invest with SuperAngel?

Join SuperAngelSyndicate.com. Once accepted, syndicate members are invited to review deal memos whenever I have a new investment to share and can invest or pass at their discretion. Minimums generally start at $2,500 and priority allocations are given to SuperAngel.Fund LPs on a first-come first-served basis, with no upfront commitment. Click here to request an invitation to the syndicate.

Join SuperAngel.Fund. Unlike the syndicate, the fund is my primary investment vehicle and provides diversified exposure to every company SuperAngel invests in, one of the most important attributes of a successful early stage portfolio. LPs also receive priority access to co-investments. Click here to request more information on the fund.

Why am I receiving this?

You are receiving this email because you are either a friend, co-investor, associate, or connection of Ben Zises or SuperAngel who at one point expressed interest in receiving updates and other correspondence from me. If you received this email in error please accept my apologies and feel free to unsubscribe at the link below.

SuperAngel.Fund is an early stage fund led by Ben Zises that invests in Consumer (CPG, eCommerce SaaS), PropTech & Future of Work.