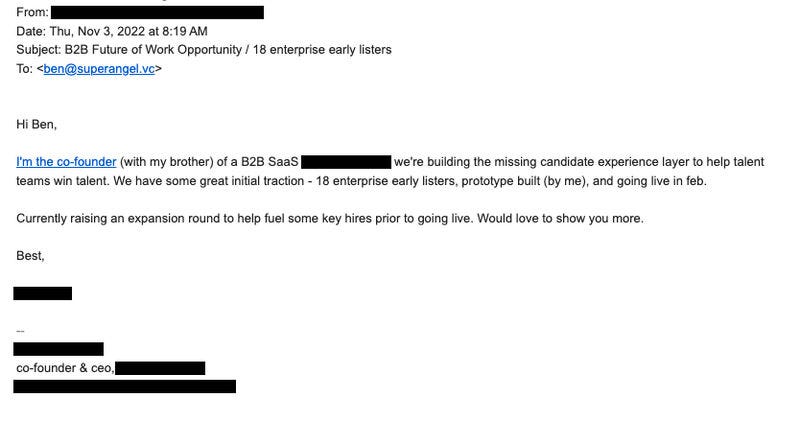

I get 100+ cold emails every month from founders pitching their companies. Here’s what the best of them all have in common:

1. The email is short and lean

2 - 5 sentences, 125-200 words maximum. If your email is too long, the investor will either skim it or skip it altogether. If they skim it, they’ll probably miss many of the crucial details of your business. Instead, only include the most important details in as few words as possible.

2. The founder has perfected their pitch

By the time you solicit Seed checks, you should have perfected your business’s pitch. You should be able to recite this pitch in your sleep.

This pitch is a 1-2 sentence statement that summarizes your business, what it does, and what you’re asking for. In the email, you need to get to the pitch (get to the point) as quickly as possible.

3. The purpose of the email is to elicit a response

This is where a lot of first-time founders go wrong. You’re not going to close a check on your first email. The only purpose of a cold outbound email is to receive a reply.

You’re not writing a dissertation, you’re trying to convince the person to email you back. That’s it.

4. The fourth and final rule is simple: SEND YOUR DECK.

Even if you write the perfect cold email, I still want to learn more about your company without having to respond to you OR do 30 minutes of research on my own.

That’s the best piece of advice about cold emailing that I can give to founders: Investors are lazy and time-constrained. The less work they have to do, the more likely they are to engage with you.

If you're a founder, are there any tricks you’ve developed in your own cold outreach strategy?

Activate to view larger image,