I just spent the past two weeks reading through over 100 pages of reports on the state of venture in Q1 2024. Here’s what I learned:

1.) We’re So (Probably) Back 🚀

Q1 seemed to be characterized by a sense of cautious optimism from investors across all stages. Many believe that we could be seeing the bottom of the market. The Fed may very well make good on its promise of a soft landing:

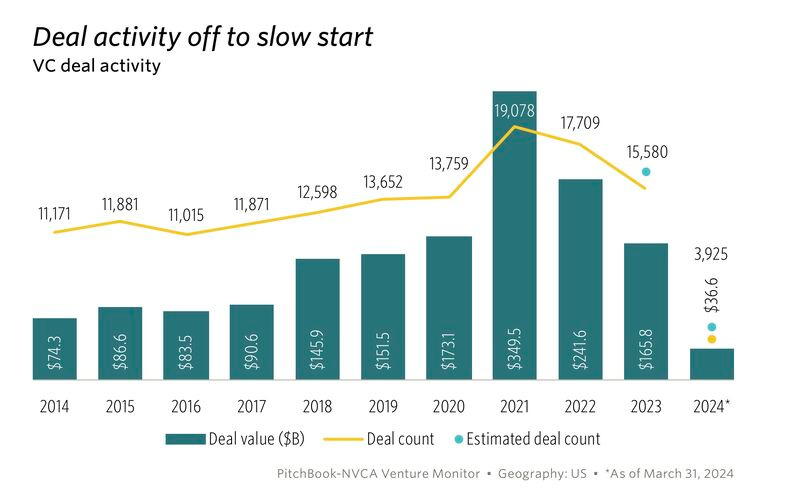

- Q1 2024 reflected the lowest fundraising volume in the past 10 years. VC added $9.3B in newly committed capital to funds (~5% of the 2022 high).

2.) Affix Your Own Mask Before Helping Others 😷

Investors across all funding stages are focusing on their existing companies, rather than adding to their portfolio. Investors are ensuring that their most promising companies are positioned for success before they make new bets.

- Insider-led rounds are more common than they have been in years.

- First-time financings are at multi-year lows.

3.) Winners Are Taking All 🥇

The companies that are able to successfully raise capital at a favorable valuation are the ones that are already demonstrating traction and product-market fit.

- Investors are more cautious and selective. the criteria have become more stringent.

4.) High Competition, Low Valuations 🥊

Startups are competing for a smaller pool of accessible capital. For founders, this creates a challenging fundraising environment. For investors, this is a phenomenal buying opportunity.

- Q1 saw an increase in down rounds, driving prices lower across the board.

- For the rounds that do close, investors often add downside protection into the term sheets.

- Translation: Cumulative dividends and liquidity multiples are back on the table.

5.) The Sidelines Are Flush 💰

Despite the tight purse strings, there’s a substantial amount of dry powder in the market. Investors continue to make capital calls to their LPs but have been slow to allocate that capital.

- Investors are currently sitting on over $300B of dry powder.

- Despite a slow start to the VC market in 2024, the quantity and quality of founders building companies does not seem to be slowing down.

All of this in just the first quarter of 2024. We still have so many things to look forward to:

- Future forward guidance and interest rate changes from the Fed

- Increasing ad spend in consumer eCommerce

- Disruption from AI

- Evolving founder trends and shifting investor optimism

It’s just the beginning of a long, exciting year ahead.

- - - - -

Want to learn more?

I wrote an entire Q1 Report summarizing current trends in startups and investing, including:

💰 The current state of VC

🌆 The explosive growth of the NYC startup scene

🛍️ The dominance of consumer businesses as compared to enterprise ones

🌱 Seed valuations and recent round sizes

📈 The performance of small vs. large venture funds

Check out the full report in the comments below 👇

Discussion about this post

No posts