SuperAngel.Fund x Q4 2025 Recap 🔥

SuperAngel.Fund is an early-stage venture capital fund that invests in Consumer, PropTech & Future of Work.

Dear Friends,

I hope you had a wonderful holiday season.

I’m pleased to share SuperAngel.Fund’s Q4 2025 update, covering Fund I (our 2021-2024 rolling fund) as well as our newly active Fund II.

Want to read the commitment letter from one of our largest LPs who rank us in the top 1% on AngelList? Click here.

Want to learn more about investing in Fund II? Click here.

Prefer to listen to this update instead? You can find the AI-generated podcast by clicking the play button below 🎙️

Introducing the Super Angel Network 🌐

While venture fundraising remains challenging by many measures, we’ve continued to grow SuperAngel.Fund II to over $9.5M from nearly 100 LPs, including both new and returning partners, with additional commitments in process.

Our LP base spans founders, operators, fellow fund managers, real estate investors, and agency owners — a community that has increasingly become a meaningful competitive advantage for both the fund and our portfolio companies.

We believe this network compounds over time, creating a durable edge across sourcing, diligence, hiring, partnerships, and founder support.

To deepen access, transparency, and collaboration, I’m excited to introduce the Super Angel Network — a private platform designed to bring together:

Founders across our portfolio

LPs who are invested across our funds & SPVs

The network has already proven valuable for introductions, deal flow, diligence, and operational support. Feel free to explore!

🔐 Access: Request password or 👉 Click here to join

📊 Fund II — Performance Summary (2025- )

As of quarter-end, Fund II has deployed $1.62M across 36 investments into 33 companies, with a $50K median check size and a $15M median post-money entry valuation.

The portfolio spans our core focus areas:

Consumer: 18

Commerce Tech: 13

PropTech/Future of Work: 5

Our entry valuations continue to compare favorably with current market data, where median seed valuations in 2025 were approximately $20M post-money, reinforcing our emphasis on early access and disciplined entry points.

To date, 10 investments have been marked up, with several others demonstrating meaningful traction that is not yet reflected in reported valuations.

Portfolio Overview

Consumer

📱 Freckle: The first phone kids love and parents trust

🍓 Feel Goods: All-natural supplements built for Gen Z

💦 Rorra: A modern water filtration company

🥣 Man Cereal: Creatine-infused, high-protein cereal for men

🪴 Arber: Modern lawn, garden, & plant care

⚡ Orka: The energy drink that tastes like water

👶 Freestyle: Babycare brand designed for the next generation

🧻 Fox Fold: Sustainable tissue solutions for hotels

🍝 Ripi: Premium frozen pasta

🍑 Create: The first modern creatine brand

♻️ Biom: Sustainable household wipes

🌿 Rosemary: The future of residential health & wellness

🧴 Cottonball: Personalized prescription skincare

Commerce Tech

📺 Upscale AI: TV marketing for modern brands

📊 Marathon Data: Brand measurement & marketing analytics

🛒 Hetal: Retail audit, analytics, and execution

🛡️ Patrol: Security & compliance for eCommerce

💰 RetailPath: Retail chargebacks on autopilot

💼 Storetasker: Marketplace for eCommerce experts

📦 Two Boxes: Returns management for brands & 3PLs

✨ Overjoy: AI-powered wholesale growth

💫 Hoop: Effortless resale infrastructure

✨ OuterSignal: Customer intelligence for merchants

🌐 Bonsai: AI commerce infrastructure

🔀 Jurni: AI-driven marketing funnels

🏬 SignalLift: AI operating system for multi-unit retailers

⚡Won.AI: AI-first commerce agency for brands

PropTech / Future of Work

✍️ Cosign: Helping landlords convert more renters

✨ Harmony: AI-powered workflow automation

🤐 Stealth: Agentic workforce planning & optimization

💻 Candidate.fyi: The candidate experience platform

🏡 Doorvest: AI-first property management

SuperAngel.Fund is an early-stage venture capital fund that invests in Consumer, PropTech & Future of Work.

Fund II is backed by the AngelList Systematic Fund-of-Funds, which ranks us in the top 1% based on ‘markups over baseline’, a leading indicator of future performance.

📝 Fund II — LP Terms

Minimum Commitment: $100k - $250k+, with a limited number of smaller allocations available

Capital Call Schedule: 10% per quarter over 10 quarters

Target Fund Size: $15m

Fees: 2% annual management fee, 20% carried interest

Fund Administration: AngelList (Legal, tax & accounting, banking, and compliance)

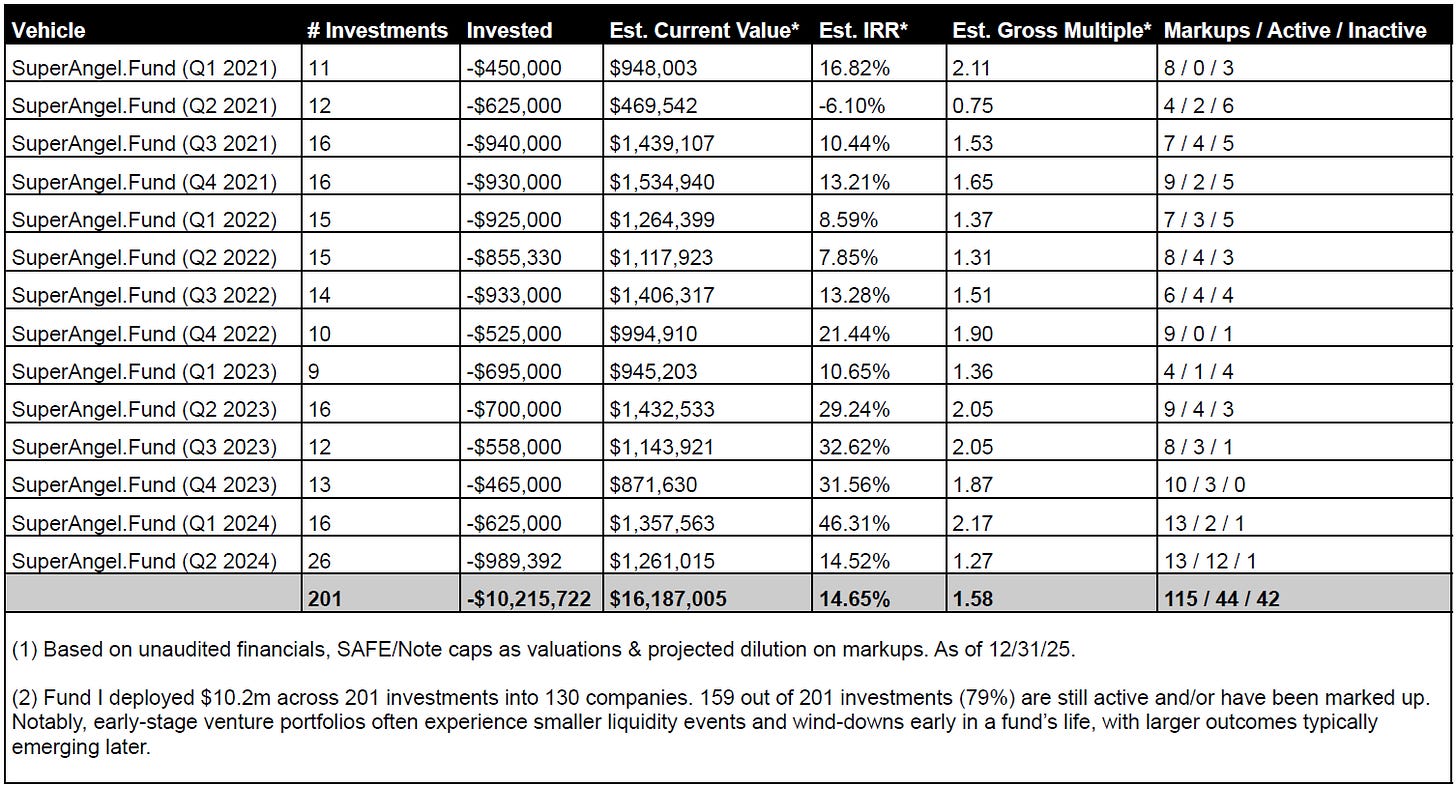

📊 Fund I — Performance Summary (2021-2024)

Fund I, our 2021-2024 rolling fund, is now closed and fully deployed

Capital Deployed: $10.2M across 201 investments into 130 companies

Estimated Current Value: $16.18M

Performance: 1.58x Gross MOIC | 14.65% Gross IRR

Portfolio Health: 159 out of 201 investments (79%) remain active and/or have been marked up

Based on AngelList Fund Benchmark Data (H1 2025), Fund I ranks in the top 10% of all 2021 vintage funds.

Notably, early-stage venture portfolios often experience smaller liquidity events and wind-downs early in a fund’s life, with larger outcomes typically emerging later. I remain confident in Fund I’s overall positioning and long-term upside as the portfolio continues to mature.

🧭 Investment Strategy, Approach & QSBS Updates

Fund II is targeting a four-year deployment period from its initial close in March 2025, with a plan to make approximately 100 investments across ~60 companies.

We focus on the earliest stages of company formation — from Pre-Seed through Series A — where pricing inefficiencies are greatest and long-term ownership can be established early.

From there, we construct broadly diversified portfolios, stay close to founders, and selectively increase exposure as breakout growth and supporting data emerge.

Recent data continues to reinforce our portfolio construction approach:

Early pricing discipline: Our entry valuations remain below market averages

Broad diversification: Designed to capture outliers while managing early-stage risk

Access advantage: A growing founder and LP network continues to improve both deal quality and volume

After simulating 20,000 venture fund outcomes, a Carta study found that larger portfolios significantly improve the probability of strong returns: funds with ~100 investments are far more likely to achieve top decile multiples of 3-4x than those with only ~20.

👉 You can review our full investment strategy here.

QSBS & After-Tax Considerations

Importantly, recent regulatory changes further enhance the after-tax profile of early-stage investing.

In July 2025, the One Big Beautiful Bill Act (OBBBA) significantly expanded the benefits of Qualified Small Business Stock (QSBS)—including:

Higher exclusion caps

Tiered holding periods

Expanded eligibility for later-stage QSBS-qualifying companies

👉 Read more on recent QSBS updates here.

Taken together, disciplined early entry, diversified portfolio construction, and improved QSBS treatment make the current vintage particularly attractive for long-term early-stage deployment.

Closing

Our strategy remains consistent: invest early, diversify broadly, support founders deeply, and compound access over time.

We continue to see a strong pipeline of opportunities and remain active on follow-on and selective secondary investments. If you come across exceptional founders in our focus areas, I’m always grateful for introductions.

Thank you for your continued trust and support.

Sincerely,

Ben Zises

ben@superangel.vc

P.S. You can access prior quarterly updates here.

📚 Recent Commentary (Optional Reading)

Throughout the quarter, I shared short posts expanding on market trends, early-stage investing, and portfolio construction. For those interested, a curated selection is linked below:

Market & Investing

Portfolio & Strategy

Founder & Fund Community

Media & Milestones

Why am I receiving this email?

You are receiving this email because you are either a friend, co-investor, associate, or connection of Ben Zises or SuperAngel, who at one point expressed interest in receiving updates and other correspondence from me. If you received this email in error please accept my apologies and feel free to unsubscribe at the link below.

SuperAngel.Fund is an early-stage venture capital fund led by Ben Zises that invests in Consumer, PropTech & Future of Work. Click here to learn more about SuperAngel.Fund II.

smart home, eco bio wellness products - open to funding and networking