SuperAngel.Fund x Q2 2025 Recap 🔥

SuperAngel.Fund is an early-stage fund led by Ben Zises that invests in Consumer, PropTech & Future of Work.

Dear Friends,

I’m excited to share the Q2 2025 update for SuperAngel.Fund II.

While we initially opened the new fund to our existing LPs back in January, we announced it more broadly here in May. Raising a fund like ours typically takes 18-24 months—but I’m pleased to report we’re already halfway to our initial target, with more than $7m+ committed from 60+ LPs and growing weekly.

Click here to learn more / apply to invest in SuperAngel.Fund II 🚀

As with Fund I, I expect we’ll have over 100 LPs by the time we reach our final close. Due to regulatory limits on the number of investors allowed, capacity is filling quickly. If you know someone who may be interested, feel free to share the fund memo or connect us directly: ben@superangel.vc. I’ll continue to prioritize introductions from within our trusted network.

As previously reported, we’re also proud to have secured an $800k commitment from Strawberry Tree Management, an institutional LP and investment advisor to the AngelList Systematic Fund-of-Funds. Their strategy uses proprietary data, predictive modeling and quantitative analysis across 25,000 funds and 13,000 startups on AngelList. Based on their core performance metric—“markups over baseline,” a predictor of future investment success—we were ranked in the top 1% of active managers as of April 1, 2025.

The Fund-of-Funds is also backed by Sequoia Capital, Squarepoint (a $100B+ quantitative asset manager), Naval Ravikant, and others.

Here’s an excerpt from their signed commitment letter 📝:

"We are excited to add Ben Zises’s Fund II, a series of SuperAngel.vc, LP to the portfolio of our Systematic Fund-of-Funds. Ben has one of the highest scores (out of hundreds of active GPs on the AngelList platform) by our preferred predictor for future investment success…We estimate Ben’s markups over baseline score to be better than the 99th percentile of the hundreds of GPs on the AngelList platform…Our data strongly suggests that Ben’s next fund has an above average chance of being an above average venture fund."

— Abraham Othman PhD, Chief Investment Officer at Strawberry Tree Management Company LLC

SuperAngel.Fund II - Investments Summary

To date, Fund II has made 12 investments, with a median check size of $50k and post-money entry valuation of $12m. These investments were spread across Consumer (5), Commerce Tech (4), and PropTech/Future of Work (3).

📱 Freckle: The first phone kids love and parents trust

📺 Upscale AI: TV marketing platform for brands

✍️ Cosign: Helping landlords convert more renters

✨ Harmony: AI-powered workflow automation

🍓 Feel Goods: All-natural supplements built for Gen Z

💦 Rorra: A modern water filtration company

🥣 Man Cereal: Creatine-infused, high-protein cereal for men

📊 Marathon Data: AI marketing automation & brand measurement

🛒 Hetal: Retail audit, analytics & execution platform

🪴 Arber: Modern lawn, garden, & plant care brand

🛡️ Patrol: Security & compliance for eCommerce

🤐 Stealth: Agentic workforce planning & optimization

We’ve also had the opportunity to co-invest alongside some of the world's leading venture capital firms, including:

776 Ventures, a16z, Adapt Ventures, Air Venture Partners, Barrel Ventures, Breakpoint Capital, Brickyard VC, Cade Ventures, Constellation Capital, Creator Ventures, Eniac, Founder Collective, Ganas VC, Geek Ventures, Groove Capital, GTM Fund, Hawke Ventures, Hustle Fund, Ignite Ventures, Interface Capital, Ludlow Ventures, Mark Cuban, Marketplace Capital, M12 (Microsoft's Venture Fund), MXV, Natureza, NextView Ventures, Nomad Ventures, NVP Capital, Ollin Ventures, OpenSky Ventures, Pari Passu Venture Partners, Precursor Ventures, Recursive Ventures, Red Bike Capital, Red Swan Ventures, Ridge Ventures, SBXI, Seaside Ventures, Spacestation Investments, TopazProp Ventures, Unpopular Ventures, Yonder VC & more.

And in several cases, we were the ones to introduce these firms to our portfolio companies.

💡 SuperAngel.Fund II - Investment Terms

Minimum Commitment: $100k - $250k+ with limited space reserved for smaller checks

Capital Call Schedule: 10% per quarter, new LPs are required to “catch up” by contributing the percentage called to date

Fund Size: $15m initial target

Fees: 2% annual management fee, 20% carry

Fund Administration: AngelList (handles Legal, tax, banking, compliance, accounting, etc.)

🚀 SuperAngel.Fund II - Deployment Period & Strategy

The fund is targeting a four-year deployment period, with a one-year extension option, beginning from the initial close on March 17, 2025. We plan to make approximately 100 investments across 60 companies, focusing on the very earliest stages–from Pre-Seed through Series A.

Our investment strategy centers on sectors where we hold a clear competitive edge in sourcing, evaluating, and supporting high-potential companies. These focus areas include:

Consumer: Brands, CPG, eCommerce SaaS, consumer tech, and commerce enablement companies, including marketplaces and businesses driven by consumer spend or engagement.

PropTech: Software, technology or digital platforms that support, overlap or connect to the real estate industry.

Future of Work: Technology companies building tools to support the evolving workforce—how, where and what people work on.

You can read more about our investment strategy on our website. I’ve also shared two recent LinkedIn posts highlighting our differentiated approach and the innovations in venture capital that enable us to execute it effectively.

📊 SuperAngel.Fund I & All-Time Performance Summary

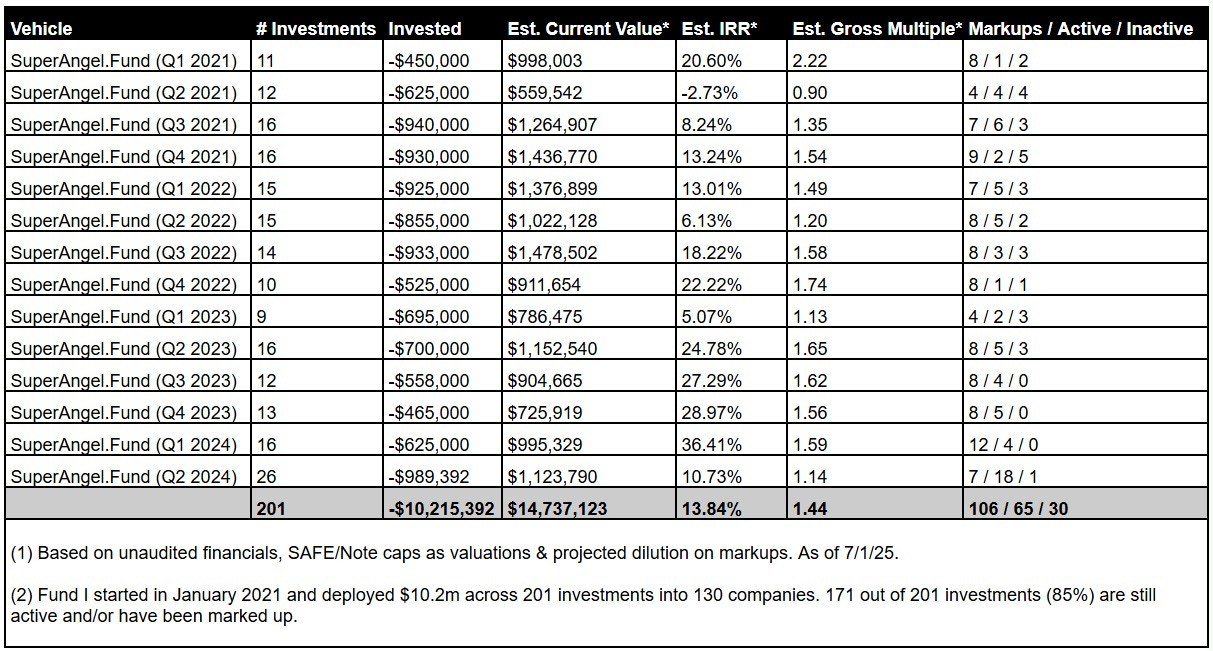

Fund I (2021-2024):

$10.2m deployed across 201 investments into 130 companies

Estimated current value: $14.7m

13.8% IRR | 1.4x gross multiple on invested capital

171 out of 201 investments (85%) are still active and/or have been marked up

Fund I is closed and fully deployed

All-Time Portfolio (2014-2025):

$21.8m deployed across 293 investments into 156 companies

Estimated current value: $34.6m

15.3% IRR | 1.6x gross multiple on invested capital

245 out of 293 investments (84%) are still active and/or have been marked up

🧭 Our Approach

A core principle of our strategy–and of successful investing more broadly–is diversification. While many funds rush to deploy capital or chase the latest “hot” category, we’ve taken a more disciplined, thoughtful, and consistent approach. Since launching Fund I in 2021, we’ve been intentionally conservative with our investable capital. This patience has allowed us to adapt to shifting market conditions and capitalize on opportunities over time.

As a result, our LPs benefit from diversification across time, sectors, and market cycles—broadening exposure to more companies and founders. In my view, that’s a key ingredient to maximizing returns over the long term.

I believe there are exceptional entrepreneurs everywhere, building world-class companies. I spend much of my time trying to find them– and to buy a ticket on their rocket ship. I remain deeply confident in our strategy and in its ability to deliver strong results.

To rearticulate our approach:

Invest as close to the first check as possible—creating a unique personal bond that unlocks a strategic information advantage over time

Focus on sectors where we have an edge—through information, experience, insight, access or network

Leverage our network—to bring in strategic capital, resources, sales, operational support and talent

Champion our founders—to drive visibility, customer acquisition, and business development

Provide unmatched founder empathy and and loyalty—with the goal of being their favorite, most helpful investor

These attributes give us a strategic informational advantage, which we aim to capitalize on by securing follow-on access in our highest-conviction companies. They also lead to both higher-quality and higher-volume deal flow—arguably the most critical factor in long-term venture success.

We also believe that the earlier the stage, the more important diversification becomes (click here for recent data to support this). Since we invest very early, our strategy helps mitigate the inevitable zeros while maximizing upside from breakout winners.

The fund has a strong pipeline of new opportunities and will continue to monitor follow-on and secondary investments into portfolio companies showing outsized growth and traction.

If you know exceptional founders raising capital in any of our core focus areas, I’d be be grateful for any introductions or referrals.

Thank you for your ongoing support and confidence.

Sincerely,

Ben Zises

Founder & GP, SuperAngel.Fund

ben@superangel.vc

P.S. You can access prior quarterly updates at the link here.

Why am I receiving this email?

You are receiving this email because you are either a friend, co-investor, associate, or connection of Ben Zises or SuperAngel, who at one point expressed interest in receiving updates and other correspondence from me. If you received this email in error please accept my apologies and feel free to unsubscribe at the link below.

SuperAngel.Fund is an early-stage fund led by Ben Zises that invests in Consumer, PropTech & Future of Work. Click here to learn more about SuperAngel.Fund II.