How I got here

My founder journey, first angel investment, discovering AngelList, SPVs, syndicates, & more

Happy Friday!

I recently passed the two-year mark since becoming a full-time “professional” angel investor, and I wanted to celebrate this anniversary by sharing more details with you about how I got here.

The story begins in 2010 after I started my first “venture-backed” company, only to shut it down four years later. Forced to cope with failure, I questioned all the decisions I had made up until that point, and then I restarted my career. Soon after, I stumbled on a chance to help other founders achieve what I could not, which kick-started a passion for what I do today. Starting out as an absolute “nobody” in the venture world, a calling began to take hold, and ever since I have set out to pursue my dreams and aspirations of becoming a “Super Angel.”

While I certainly don’t consider myself a “Super Angel” yet, I believe that I have taken many of the steps required towards achieving that goal. Through consistency, hard work, ruthless dedication, above-average risk tolerance, commitment to the craft, patience, a drive for greatness, and a little bit of luck, I am starting to feel the universe pull me closer to that elusive point. I have invested the first checks into three companies that are each becoming category-defining, deployed $15 million from a collection of more than 300 LPs, and backed the founding teams of more than 100+ companies.

My hope for this post is that it will stand the test of time and serve as a tentpole marker in my career that I can look back on when I write the next version of it 5-10 years from now. I also hope to shine a light on what got me off the mat and into the ring, in case it sparks an idea or encourages you to take action in your life. As always, my inbox is open and I welcome any thoughts, questions or feedback (ben@superangel.vc).

One last thing before we get started. At the very end of this post I list two ways you can come along the SuperAngel journey with me. In case you don’t make it that far…

Join SuperAngelSyndicate.com. Once accepted, syndicate members are invited to review deal memos whenever I have a new investment to share, and can choose to invest or pass based on their own discretion. Minimums generally start at $2,500 and priority allocations are given to SuperAngel.Fund LPs on a first-come, first-served basis. Click here to request an invitation to the syndicate or here to view my deck.

Request information on SuperAngel.Fund. Unlike the syndicate, the fund is my primary investment vehicle and provides diversified exposure to every company SuperAngel invests in, one of the most important attributes of a successful early stage portfolio. LPs also receive priority access to co-investments. Click here to request more information on the fund or here to view my deck.

My Founder Journey (2010 - 2014)

As my second job after graduating from Boston University, I worked as a retail real estate leasing broker in NYC. The firm I worked for represented landlords seeking tenants for their vacant retail spaces, and helped tenants find spaces to open new retail store locations. A few weeks into the role, I could not for the life of me understand why most of the workload was done manually and almost exclusively offline.

For example: My company was hired by Verizon Wireless to find 10 new store locations in Manhattan. In order to identify locations that met their criteria, I had to walk around the streets (sometimes I roller skated to save time), write down phone numbers from storefront signs, call the landlord or listing brokers, and collect a dozen data points on the spaces, including their size, asking rent, and other variables. I wondered why there was no online multiple listing service (MLS) that landlords, brokers, and tenants could easily use to collectively share information in a more efficient manner (think Zillow or StreetEasy for retail space). I was unable to get the idea out of my head, and after researching obsessively to see if anyone else was working on it, and why it would or would not be a good idea, I decided to build it myself.

I painstakingly worked on RetailMLS.com (of course, the URL now redirects to my LinkedIn page), which aimed to become the Zillow or StreetEasy for retail store listings. You can see the original deck I created here and a few screenshots and photos of me pitching the business here.

To get it off the ground we needed outside capital, so I pitched everyone I knew or who was willing to listen. I heard “no” what felt like 10,000 times before eventually raising $2 million from 30 angel investors and an early-stage seed fund. I hired and scaled a team, brought on a technical CTO, successfully launched, and was featured in countless press articles. But as well as it was going, the business had no revenue. I had made a decision early on not to charge either side of the marketplace to reduce friction from acquiring users and listings. My goal, once we reached a critical mass of users, was to build paid features and start collecting money for “Featured Listings” or what I called the “RetailPRO” search subscription.

Over four years, our team went through what felt like an endless number of ups, downs, successes, failures, wins, and losses. There is nothing quite like coming up with an idea that you think the world needs, putting your blood sweat and tears into building it, and then seeing real people - other human beings! - actually use your product or service the way you envisioned or intended them to.

We had acquired thousands of listings and active users, clearly demonstrated the need for our service, iterated and pivoted multiple times, refactored our code base, given hundreds of product demos, attended dozens of industry events, pitched hundreds of VCs across the country, including a road show on Sand Hill Road in Silicon Valley, and yet failed to raise a successive round of funding. I was forced to wind down the company.

Though impossible to see in the heat of the moment, it is obvious looking back that those experiences gave me the major competitive advantage that I have today: founder empathy and a unique understanding of the startup journey. Nearly a decade after it closed, I still get asked why RetailMLS did not work out. The main reasons, I believe, were that (i) we blew through $2 million and had yet to start the revenue engine - giving investors pause or concern about our real traction and customer willingness to pay, and (ii) I was pitching as a solo, non-technical founder which presented significant risks given that we were ultimately building a software company.

It sounds cliché, but this is where the old saying “When one door closes, a window opens” started to ring true for me.

First Angel Investment (2014)

As RetailMLS was on its last legs, I flew to Miami to pitch a potential investor in an effort to keep the business alive. I decided to stay the weekend with a friend, who brought me to a party in Miami Beach. Minutes after arriving I overheard another guest - a total stranger - talking about a “toothbrush company” that his friend was working on. My ears perked up and I walked over to the group of people chatting about it to learn more.

At the time I had been an early customer of Dollar Shave Club, and was particularly aware of the attention they were capturing in the antiquated men's grooming market. I was directly in their target customer demographic and wildly attuned to the disruptive potential they presented to legacy incumbents in such a large, unsexy personal care category. While it's easy to forget just how innovative DSC was at the time, I think we all remember how exceptional their viral video was (currently standing at 28 million views!). I saw a similar untapped opportunity in oral care and was predisposed to the idea, coupled with the fact that I used to purchase dozens of toothbrushes in bulk so I could constantly keep my brushes fresh and clean, being a bit of a germaphobe myself.

A few days after I returned to NYC, the party guest I had met in Miami introduced me to Simon Enever and Bill May. The two were both industrial engineers and product designers, working full-time for respective agencies in Manhattan. I invited them into my office, and after seeing the toothbrush prototype IRL, hearing their expansive vision to disrupt and improve the oral care industry first hand, and noticing the determination in their eyes, hearts, and minds, I handed them a check for $10,000. I made a commitment to support them in ANY and EVERY way possible to help turn their vision into a reality. I spent countless hours making investor intros, hosting pitch events, copy editing emails, providing deck feedback, introducing them to my top legal advisors, and more. The company was originally called Elements, but after an exhaustive branding exercise it was renamed quip. Today, the company stands as an industry leader amongst both CPG and healthcare brands, having sold more than 50 million products to millions of customers around the world, and delivering innovative digital oral care solutions for the modern age.

Special Purpose Vehicles (SPVs) & Syndicates (2015)

A few years later I received a call from a friend looking to sell shares in one of his high-performing angel investments that he had made a few years prior. Based on what I knew about the company, and the price he was offering to sell a few shares at, I believed it would build on its success over time. Instead of introducing him to another investor, I decided that I wanted to buy the shares myself, and I invited a few other friends to join me so that we could all share in the risk/reward. That led me to learn about the concept of an SPV (Special purpose vehicle) or Syndicate, which is a group of investors that pools capital to invest in deals.

Besides sourcing this “off-market” opportunity, I compiled, presented, and coordinated all the materials that my friends needed to feel comfortable investing with me. I acted as the “Lead” or “Manager” of the SPV. In exchange for this work, I would earn a success fee if and when the investment turned profitable - known as carried interest. After repaying their initial investment, every dollar of profit would be split 80% to them and 20% to me.

A syndicate is a group of investors that pools their capital to invest into deals (SPVs).

I worked with lawyers and an accountant, opened a bank account, got everyone to sign documents, collected money, and closed my first SPV on December 12, 2017. Six of us invested $350,000. So far, that investment has returned nearly all the initial capital we put in, and we still hold a majority of the shares we purchased. The following year I completed four more SPVs with a dozen new partners, investing an additional $840,000.

Overseeing all the paperwork, legal, tax, and accounting docs required to make each investment and manage each SPV on an ongoing basis was time-consuming and onerous. For each one, I had to file tax returns, issue K1s, track expenses, pay annual franchise tax and registered agent fees, and communicate investor updates to the group. As organized as I am (and those who know me know I am incredibly organized), the process was much more burdensome than I expected. Because of that, I considered whether or not to lead more SPVs as I would not sacrifice tending to my full-time job at the time.

I continued angel investing and added six new companies to my portfolio in 2018, including Swag.com, which grew from $0 to $30m in sales and sold to CustomInk in 2021 for a venture-like exit.

As my network grew and the founders that I had already backed started to notice my passion for supporting early stage companies, both the quality and quantity of my deal flow increased. I spent a lot, and I mean A LOT, of time on nights and weekends getting to know other VCs, angels and co-investors, often making warm intros, connecting founders with potential co-founders, lawyers, accountants, designers, developers, customers, and more. I was shameless and unapologetic. I sent deals to other investors, most of whom were much more experienced and established, and had significantly more capacity to invest than I did. Some of the people I shared deals with I knew well, some I met once or never at all. All on behalf of, and in service of founders.

“The way to build a brand in this business is to help other people.” -Naval (Founder, AngelList)

The Second One (2018)

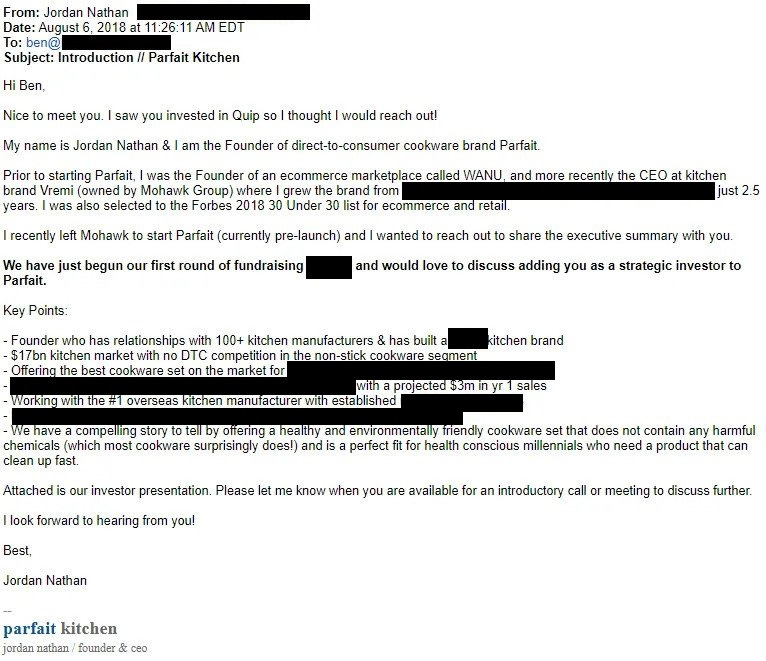

In the summer of 2018 I received a cold email from a founder named Jordan Nathan who was starting a cookware company called Parfait. He discovered me by filtering through profiles on Crunchbase, an industry directory that featured startups and investors. What stood out in his email (below) was the personal touch, thorough, yet remarkably concise and confident pitch, prior leadership, sales, and category experience. As luck would have it we lived five blocks from each other in the West Village, and we met in person a few days later. We met for coffee weekly over the course of a month and got to know each other intimately, speaking to mutual references, including on my side, his former employer, personal contacts, and even doing a background check. A few weeks later I decided to write the first check into his company, and help him close out the remaining pre-seed round almost entirely from my network. As the company approached launch, they completed a rebranding exercise to change the name to Caraway, and it has since become one of the fastest growing consumer brands of all time.

Discovering AngelList (2019)

Sometime in early 2019 I discovered AngelList. Holy. Fucking. Shit. For a few thousand dollars, over the entire life of the investment (typically 10-12 years), AngelList would take ALL, and I mean ALL, of the setup, legal, banking, tax, and accounting work off my plate. They would give me a secure deal room with access control permissions and custom links to invite prospective investors, open up a bank account, collect and hold all the money, send funding notifications and confirmations for wires and ACHs, calculate member ownership percentages, as well as pro-rata allocations and expense attribution, manage our stock certificates, verify legal terms for accurate conversions, and process distributions when the time comes. They even track performance metrics and handle SEC and regulatory compliance. Instead of performing these crucial tasks myself (or with the help of expensive providers), I could focus on building relationships with founders, hear more pitches, research new companies, secure allocations into great rounds, and provide support to portfolio companies.

I was giddy. With AngelList as my partner I felt confident that I could tackle the core “value-add'' functions to become a successful investment manager: (1) fundraising, (2) sourcing winners and performing due diligence, and (3) supporting portfolio companies.

SuperAngel is Born

As I thought about scaling and inviting more people from my network to invest with me, I wanted a brand to operate under. Like a lot of beginners, I was a fan and disciple of Jason Calacanis and his book “Angel”. I closely followed him along with other notable “SuperAngel” investors like Fred Wilson, Howard Lindzon, Scott Belsky & Spencer Rascoff.

I aspired to be as recognized, well-networked, and successful as those others. I wanted to be a SuperAngel.

I logged onto GoDaddy and snatched the domain name SuperAngelSyndicate.com for a whopping $2.99. A few months later I negotiated and coughed up $1,500 for SuperAngel.vc.

I launched my first SPV on AngelList in October 2019, investing $2 million more across eight additional SPVs through 2020. Since the “back-office” was now heavily automated and off my plate, I was able to substantially lower the minimum that friends could invest with me to $2,500. I had gone from six people in my first deal to regularly having 25, 50, and even 99 investors in a deal. Without AngelList, there would have been no cost-effective way that I (or my syndicate network) could have successfully coordinated legal docs, funding timelines, wire confirmations, K1s, and more - I was hooked.

Aside from SPVs, I continued making direct investments, many of which had much tighter closing deadlines. In certain cases, there wasn’t enough time for me to prepare a deal memo and wait for other people to get caught up to speed on the opportunities and information I was seeing. So I continued to invest my own money, and do what I could to share deals with friends, all while keeping a full-time job and making sure to over-deliver on my responsibilities and commitments in that capacity.

Going For Three (2020)

On April 21, 2020, in the earliest days of the pandemic, I was catching up with Lolita Taub, a highly regarded angel investor and fund manager. After exchanging our respective investment criteria, she mentioned a company that had just come across her plate that sounded like a possible fit for me. She introduced me to a founder named Vanessa Dawson who was starting a new company called Evergreen as an all-natural alternative to the chemically-filled products in the lawn, garden, and plant care space.

We hit it off on the first call. I ran through my standard reference checks and due diligence process before writing the first check into her company, and I also spun up a deal memo that I shared with my syndicate network. Just like the others, Evergreen decided to change its name prior to launch. Almost exactly one year from our first correspondence, on Earth Day 2021, Vanessa launched Arber into the world. Since then, Arber has seen explosive early growth with unprecedented launches and distribution in thousands of doors throughout the world’s top retailers including Walmart and Target. Across SuperAngel vehicles, we currently represent the largest shareholder in the company.

The Decision (2020)

It was near the end of the first Covid summer. I was burnt out from my “day job” where I was the COO of an NYC-based real estate investment and property management company. Our firm had just completed a large M&A transaction that 10x’d our team and business overnight. My wife and I were blessed with our first daughter a few months prior, and like many people during that time, I was re-assessing and re-evaluating my professional circumstances.

It goes without saying that if you want to be the best in the world at a craft, you better be willing to give it your full-time attention. And given my goals of becoming a SuperAngel, I knew that was exactly what I needed to do. With AngelList in my back pocket as my “secret weapon,” I decided to do what I love as my entire career focus: work with founders to provide unwavering dedication and support. Help champion them and their success throughout the short, medium, and long term. So I walked away from my safe, reliable, and only income-producing job in real estate to become a full-time “professional” angel investor. It has since proven to be one of the best decisions of my life.

With AngelList in my back pocket as my “secret weapon,” I decided to do what I love as my entire career focus: work with founders to provide unwavering dedication and support. Help champion them and their success throughout the short, medium, and long term. So I walked away from my safe, reliable, and only income-producing job in real estate to become a full-time “professional” angel investor. It has since proven to be one of the best decisions of my life.

Launching a Fund (2021)

With 50 investments under my belt and $4 million deployed, I felt confident that I had a strong enough focus, filter, and expertise in identifying and evaluating what a potential outlier company looks like. And after completing more than a dozen SPVs, I was comfortable with the responsibility of managing other people’s money alongside my own. I already had a handful of high-performing companies in my portfolio showing breakout success (achieving what I describe as “the impossible”), I had established unique sources of deal flow, and I had identified categories to invest in where I was passionate and had an informational, educational, access or network competitive advantage.

A few months prior AngelList announced a new vehicle called Rolling Funds that allowed new fund managers to get started quickly and more efficiently. Since I did not have a legacy fund structure in place, I was willing to try something new and jumped right in. Back to GoDaddy. $8 bucks later, introducing SuperAngel.Fund.

I finished my former real estate duties and was open for business on January 1, 2021. Since then, across SuperAngel.Fund and SPVs, we have raised and invested another $11 million ($15m total to date), and added 75 more companies to the SuperAngel family. I’m a little over two years in, and while it certainly hasn’t been easy, there is nothing else in the world I’d rather do. As my friends and family can attest, I come to work every day excited and laser-focused on delivering value to founders, which in turn, delivers value to my LPs (and me).

Thank you to everyone who has enabled me to find my passion and pursue it. I look forward to keeping you updated on my journey. As always, my inbox is open and I welcome any thoughts, questions or feedback (ben@superangel.vc).

Ben Zises

SuperAngel.Fund

If you are interested in participating with SuperAngel there are two options:

Join SuperAngelSyndicate.com. Once accepted, syndicate members are invited to review deal memos whenever I have a new investment to share, and can choose to invest or pass based on their own discretion. Minimums generally start at $2,500 and priority allocations are given to SuperAngel.Fund LPs on a first-come, first-served basis. Click here to request an invitation to the syndicate or here to view my deck.

Request information on SuperAngel.Fund. Unlike the syndicate, the fund is my primary investment vehicle and provides diversified exposure to every company SuperAngel invests in, one of the most important attributes of a successful early stage portfolio. LPs also receive priority access to co-investments. Click here to request more information on the fund or here to view my deck.

Why am I receiving this?

You’re receiving this email because you are either a friend, co-investor, associate, or connection of mine who at one point expressed interest in receiving updates and other correspondence from me.

SuperAngel.Fund is an early stage fund led by Ben Zises that invests in Consumer (CPG, eCommerce SaaS), PropTech, & Future of Work. You can learn more at SuperAngel.Fund.

Hello there,

Huge Respect for your work!

New here. No huge reader base Yet.

But the work has waited long to be spoken.

Its truths have roots older than this platform.

My Sub-stack Purpose

To seed, build, and nurture timeless, intangible human capitals — such as resilience, trust, truth, evolution, fulfilment, quality, peace, patience, discipline, relationships and conviction — in order to elevate human judgment, deepen relationships, and restore sacred trusteeship and stewardship of long-term firm value across generations.

A refreshing take on our business world and capitalism.

A reflection on why today’s capital architectures—PE, VC, Hedge funds, SPAC, Alt funds, Rollups—mostly fail to build and nuture what time can trust.

“Built to Be Left.”

A quiet anatomy of extraction, abandonment, and the collapse of stewardship.

"Principal-Agent Risk is not a flaw in the system.

It is the system’s operating principle”

Experience first. Return if it speaks to you.

- The Silent Treasury

https://tinyurl.com/48m97w5e