Founder Friday is a content series from SuperAngel.Fund that highlights companies across our portfolio and the inspiring founders behind them.

In our 44th edition we are featuring Alek Koenig, Founder & CEO of Settle, a cash flow management platform built to help eCommerce brands scale.

Alek Koenig knows a thing or two about finance. After graduating from The Johns Hopkins University with a degree in Mechanical Engineering & Mathematics, Alek spent six years at Capital One in the risk management and consumer lending departments. He then worked Affirm as Head of Credit and Director of Strategic Partnerships. With a front row seat to businesses looking for better solutions to bill pay, credit and related services, Alek identified a major hole in the market that needed to be filled.

In November 2019 he founded Settle, an all-in-one payments solution tailored to the needs of growing consumer brands, helping them pay bills, manage purchase orders, track invoices, and access flexible working capital solutions. His mission? To make it easier for founders to build the incredible brands we love. Soon after coming up with the idea he recruited a prior co-worker, Shane Moriah, to join as CTO.

A quick primer: As many of you know brands generally operate under unique capital constraints as compared to software companies. They sell physical products that often require large upfront outlays of cash, for months at a time, to purchase raw materials and inventory prior to selling finished goods to an end customer - whether it be a consumer directly (e.g. DTC), or retailer - and getting paid back their capital investment along with profits. This dynamic creates both an opportunity and challenge. Rather than use more expensive investor equity to finance inventory purchases, brands seek alternative forms of debt financing to cover these recurring cash conversion cycles. The problem: Traditional lenders do not understand the nuances of consumer product businesses making it extremely difficult for them to underwrite a brand’s risk profile. As such, a new class of lenders has emerged with exactly this skillset and Settle is among the leaders of this pack.

Since launching in June 2020, Settle has grown rapidly via word of mouth with founders describing it as “lifesaving” for their business. Today, they work with hundreds of brands including Dagne Dover, Lalo, Starface, and Branch.

Settle is a cashflow management platform built for growing eCommerce businesses. Its platform provides a centralized place to manage invoices and purchase orders, pay bills, track payment statuses, and apply for flexible working capital to help smooth out the months-long gaps between inventory purchases and product sales. Settle minimizes the burden of monitoring when and where company dollars are spent—giving founders and small business owners more time to focus on their products and customers.

If you are a brand or accounting firm that works with brands, click here to learn more. If you are a super talented engineer, product manager, product designer, or generally looking for a new career change within a high growth company, click here to learn more.

Describe your company in 5 words or less?

Alek: Cashflow management for e-commerce brands.

What was your primary motivation for starting your business?

Alek: Personal frustrations with bill.com; it was unusable for me, clunky and slow. Once I conducted 30+ user interviews, I was convinced that Settle could be a thing. Secondly, it would be predatory lending in the space. Businesses get less protection than consumers, so there are more bad actors out there.

What new product/feature are you most excited about and why?

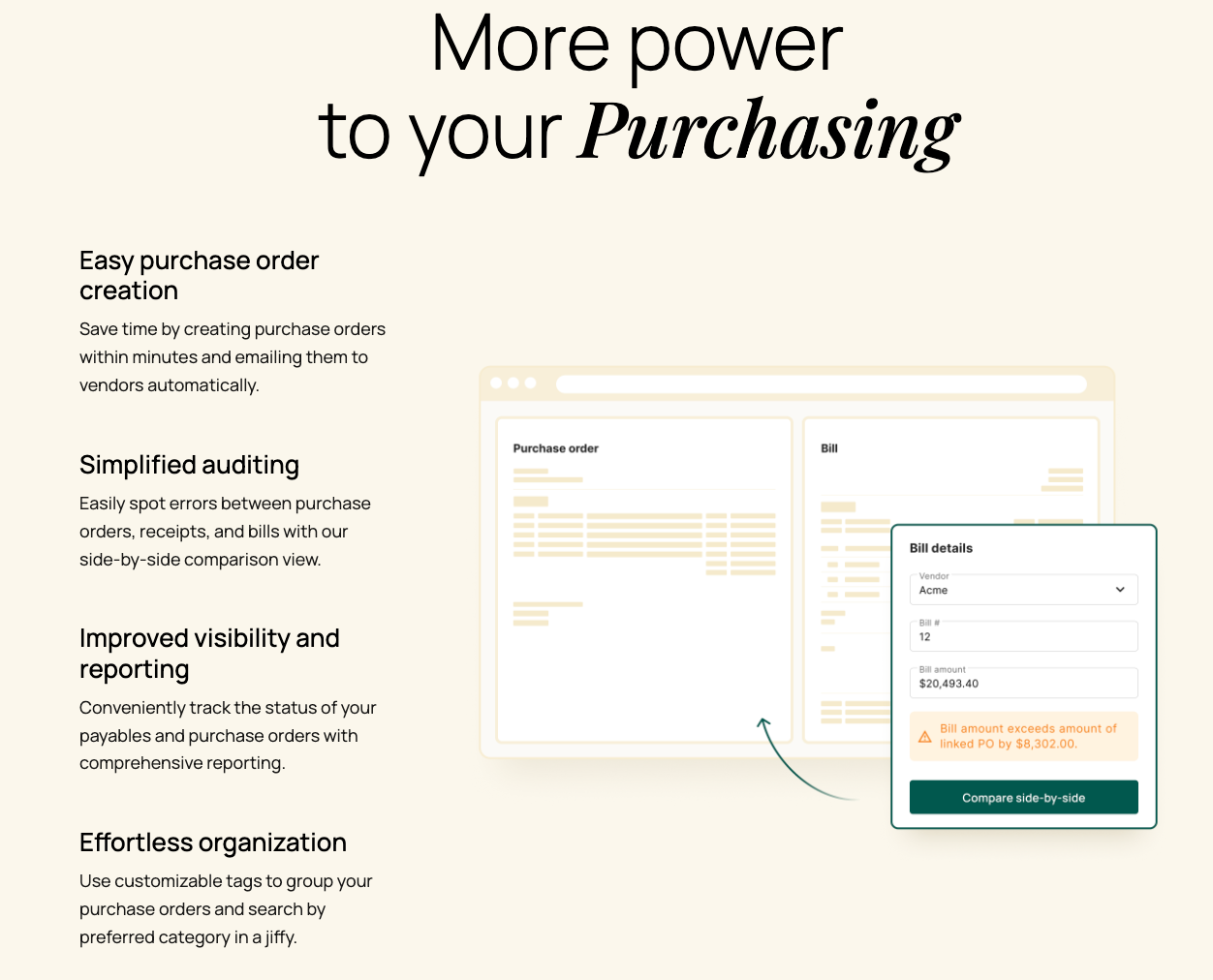

We actually just launched a whole suite of features to simplify the purchasing workflow for eCommerce brands. Now they can use Settle to create and email Purchase Orders in minutes and easily 3-way match POs, receipts, and bills all in the same platform they use to pay their vendors. Purchasing is yet another way we’re bringing enterprise-level tools to small consumer brands without the enterprise-level pricing. To get started check us out here!

What piece of advice would you give an entrepreneur starting a business today?

Alek: Ensure the solution you’re offering is a pain-killer, and not a vitamin. Make sure you’re solving a real problem.

What do you love to do in your free time?

Alek: What’s free time? Settle pretty much consumes me. But in the time I do have, I definitely dedicate it to my wife and daughter.

What is the most interesting place you’ve visited recently and why?

Alek: I haven’t been to too many places recently but when I went back to Poland, where I’m from, I made a trip out to Lviv, Ukraine. We have 15 of our engineers based there and it was my second time since starting the company. Lovely, small town in western Ukraine. It was great to spend time with them in person and I am hopeful peace is made soon. I would love to go back!

What is your favorite app or tool in your work life and in your personal life?

Alek: I’d say gated.com. It's an email plug-in to help reduce noise in my inbox while also benefiting charity. I get so much spam all day and every day, and it really keeps my inbox clean so I don’t get context switching I don’t want. If you live in your email and want to keep some flow you have to get it.

What do you believe is the most important skill or attribute of a successful founder?

Alek: Grit. You’re going to run into so many walls, you need to persevere and fight through it.

Want to invest with SuperAngel?

Join SuperAngelSyndicate.com. Once accepted, syndicate members are invited to review deal memos whenever I have a new investment to share, and can choose to invest or pass based on their own discretion. Minimums generally start at $2,500 and priority allocations are given to SuperAngel.Fund LPs on a first-come, first-served basis. Click here to request an invitation to the syndicate.

Join SuperAngel.Fund. Unlike the syndicate, the fund is my primary investment vehicle and provides diversified exposure to every company SuperAngel invests in, one of the most important attributes of a successful early stage portfolio. LPs also receive priority access to co-investments. Click here to request more information on the fund.

SuperAngel.Fund is an early stage fund led by Ben Zises that invests in Consumer (CPG, eCommerce SaaS), PropTech & Future of Work. You can learn more at SuperAngel.Fund.

Why am I receiving this?

You are receiving this email because you are either a friend, co-investor, associate, or connection of Ben Zises or SuperAngel who at one point expressed interest in receiving updates and other correspondence from me. If you received this email in error, please accept my apologies and feel free to unsubscribe at the link below.