The unquestioned rule of “10 years to exit” isn’t as consistent as we all believed. Here’s why that’s a good thing:

First of all, everyone in this industry forgets that venture capital has only existed as a formal asset class for about 40-50 years.

As a result, we tend to get tunnel vision.

We fixate on the arbitrary timelines that we’ve established over the past 20 years to determine the pace of how quickly an investment *should* succeed or fail. We set our standards based on industries that are constantly evolving and an economy that is too complex to “benchmark” against.

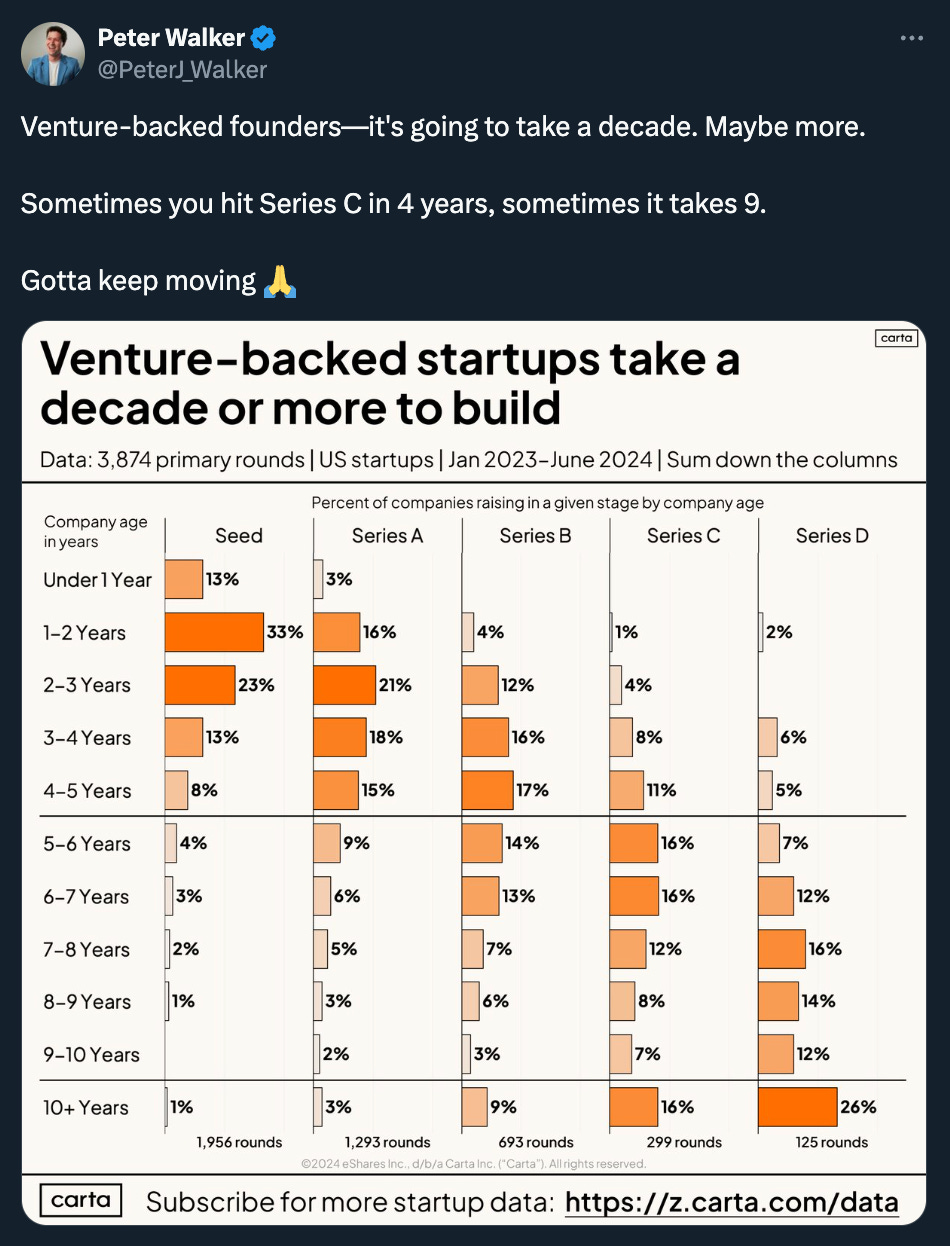

Peter Walker nails it here in his Tweet.

There’s no formula, pace, or benchmark for success. Sometimes it takes 4 years, sometimes it takes a decade or more.

One of the trends I’ve been seeing over the past 5 years is that exits, on average, are much further out. I like to tell founders that the 10-year benchmark is shifting and that, “15 years is the new 10.”

It’s now just taking longer and longer to get to an exit, and that’s ok! My advice, especially to investors, is to buckle up and settle in. The ones with the most patience will win.

The game of startups is a simple game of attrition — The longer you survive, the more likely you are to succeed.

Discussion about this post

No posts